A Resiliency Framework for Investing in the Face of Uncertainty

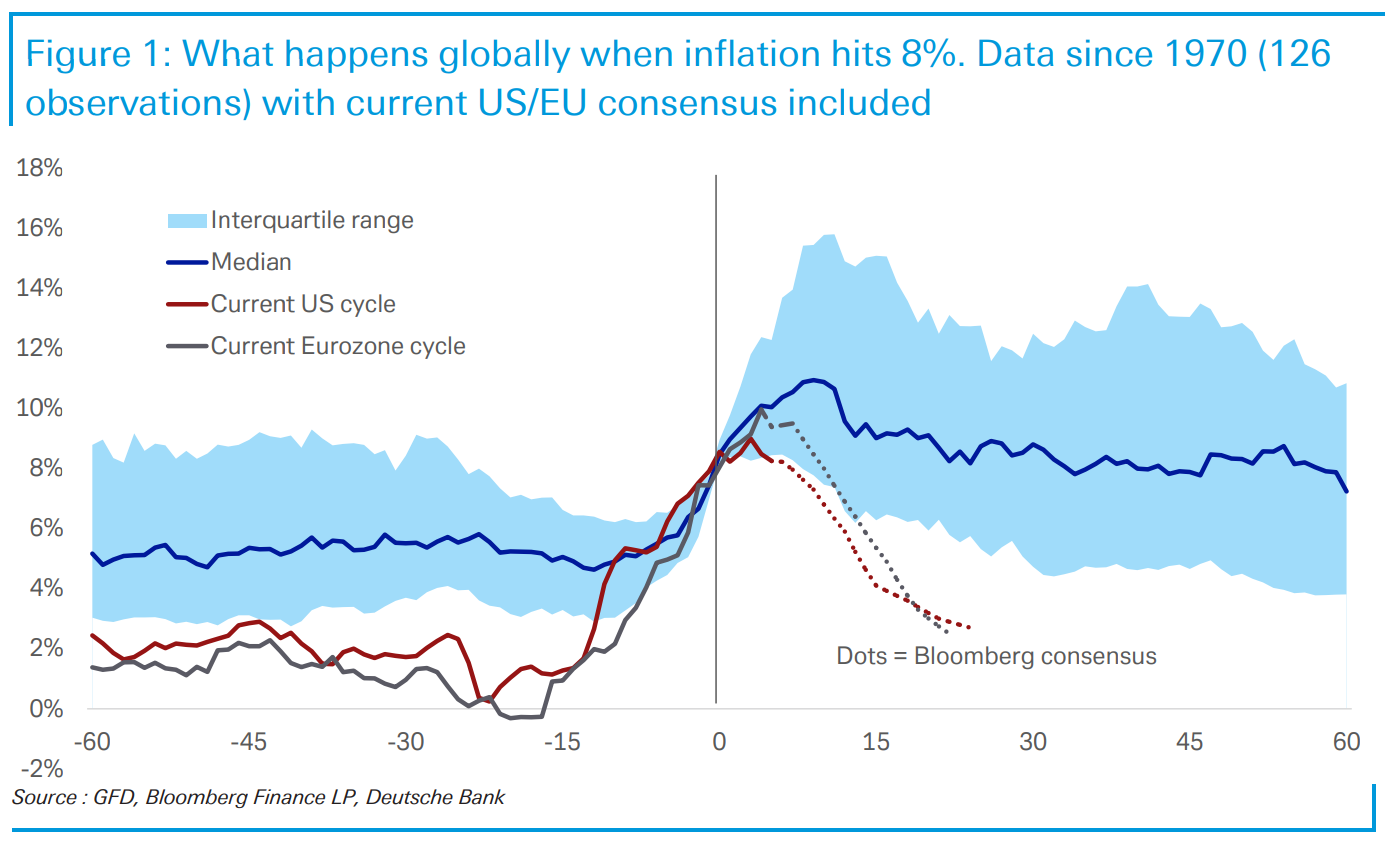

In our 2023 outlook the one thing we knew for certain was the path forward would not chart a straight line. We are a little more than a month into the year and have already started to see the squiggly lines of reality intermingle with the straight lines of forecast extrapolation. On this topic, one of our favorite relevant charts is shown below from Deutsche Bank.

Source: Deutsche Bank Cross-Discipline Thematic Research October 25, 2022

Forecasts are certainly possible and often probable, though reality regularly takes a different path—sometimes with large variance, other times with little. The chart above highlights two important things. One, the intended takeaway, that in the past bringing inflation down once it has reached 8% has proven to take longer than what the market may be expecting this time. The second, unintended in its publication, is the importance of an investment process that can not only adapt quickly to a changing set of facts but that also trades perfection or certainty in the present for varying amounts of resiliency and optionality in the future.

Given that credit investing generally involves smaller relative upside vs downside, the focus on maximizing future optionality and resiliency, versus solving for perfection in the current environment, is a key element of our investment process. Said differently, because mistakes can have an outsized impact on overall returns to credit investors, we want to have confidence that management teams we invest with have multiple levers to pull and significant redundancy to be able to pay back both principal and interest. Levers often include free cash flow generation, existing liquidity, secured debt capacity, easily separable and salable assets, or access to other forms of debt or equity capital.

Thus far in 2023 we have received many different data points that either reinforce or reduce our confidence in single name and portfolio resiliency. Going through the 4Q22 earnings of over 200 companies we closely follow, we have gained more confidence in the idea that while fundamentals are coming back down to earth after the slingshot coming out of the pandemic, the underlying resiliency of both corporates and the consumer is broadly intact.

To highlight this, on its recent earnings call the management team of Bank of America commented that spending is coming down modestly BUT the consumer cohort with pre-pandemic deposit balances between $2,000 and $5,000 (average of $3,400) still has an average balance of $12,800 (this cohort’s average balance peaked earlier in 2022 at $13,400). That is close to 4x pre-pandemic levels!

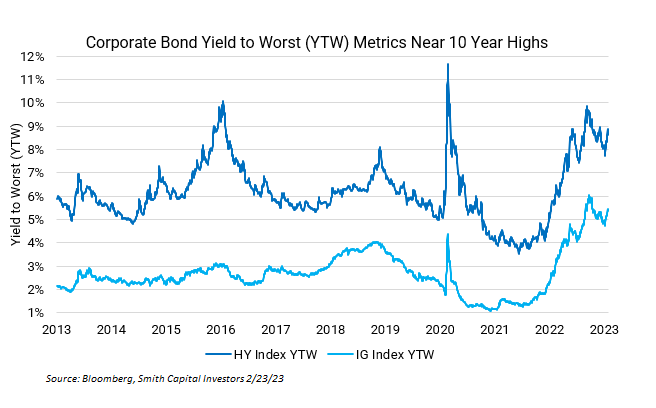

Another dynamic that provides resiliency is the historically high amount of current yield available to credit investors. We have talked in prior pieces about the math behind the market, but the main idea here is that elevated income provides a tailwind for credit investor returns that can act as a cushion from negative outcomes that lead to price declines. In other words, if credit returns are made up of 1) current income and 2) price changes, the fact that 1) is higher will either lead to higher returns, all else being equal, or will allow for 2) to be a larger negative before overall returns turn negative. Currently the yield to worst (YTW) metrics of the Bloomberg U.S. Intermediate Corporate Bond Index (IG Index) and Bloomberg U.S. Corporate High Yield Bond Index (HY Index) represent the 99th and 94th percentile, respectively, of all readings over the past 10 years (100 being the widest).

INSTITUTIONAL INVESTOR USE ONLY

We are also cognizant of data points in the current environment that challenge single name and portfolio resiliency. One such data point is current spread valuations across corporate credit. While YTW metrics are high, that dynamic is primarily a result of higher risk-free rates, with option-adjusted spread (OAS) levels on the IG Index and HY Index in the 62nd and 57th percentile, respectively, on a trailing 10 year basis. At issue here is how well credit investors are being compensated for potential adverse scenarios, such as a Fed-induced recession. Looking back at OAS levels seen during previous recessions, one could infer that current credit valuations are pricing in a relatively low probability of a recession materializing in the near term. This overall market pricing may be fair for now. However, given the unprecedented nature of this Fed hiking cycle, we are focused on identifying individual securities where current valuations incorporate more bearish expectations, and the perceived upside/downside profile is more favorable.

Arguably the most important variable in the current market is Fed policy, and we have received some noteworthy tier one economic data: stronger than expected retail sales (2/15/2023), stickier than expected y/y CPI (2/14/2023), and a materially stronger than anticipated change in Nonfarm Payrolls (2/3/2023). While there is some probability that the Fed will be able to conquer inflation and manufacture a soft landing for the economy, in general, we would argue that the determination of the Fed to raise interest rates challenges resiliency in fixed income portfolios. Investment processes or portfolios built on the current level of interest rates, or path dependency around the trajectory of interest rates, may struggle to provide adequate downside protection for investors should other scenarios arise.

In any short-term scenario the portfolio that is optimized for the singular realized outcome may outperform, but over the long-term, we believe that focusing on risk-adjusted returns and both single name and portfolio resiliency and optionality will prove successful. We will continue to monitor sources of resiliency (corporate/consumer fundamentals and YTW levels) and challenges to resiliency (OAS levels, Fed policy) while remaining nimble in our positioning and humble in our convictions. One thing is for certain, we are excited about the opportunity set created from heightened volatility and the divergent impact of Fed policy on individual businesses. We feel that the current environment is fertile hunting ground for bottom-up, fundamentally focused investors.

INSTITUTIONAL INVESTOR USE ONLY

Jonathan Aal, Portfolio Manager Credit Opportunities Fund

Garrett Olson, Portfolio Manager Credit Opportunities Fund

Let’s keep talking!

Smith Capital Investors

Our mailing address is:

Smith Capital Investors

1430 Blake Street

Denver, CO 80202

303-597-5555

833-577-6484

info@smithcapitalinvestors.com

www.smithcapitalinvestors.com

The opinions and views expressed are as of the date published and are subject to change without notice of any kind and may no longer be true after any date indicated. Information presented herein is for discussion and illustrative purposes only and should not be used or construed as financial, legal, or tax advice, and is not a recommendation or an offer or solicitation to buy, sell or hold any security, investment strategy, or market sector. No forecasts can be guaranteed, and the author and Smith Capital Investors assume no duty to and do not undertake to update forward-looking predictions or statements. Forward-looking predictions or statements are subject to numerous assumptions, risks, and uncertainties, which change over time. Actual results could differ materially from those anticipated in forward-looking predictions or statements.

Any investment or management recommendation in this document is not meant to be impartial investment advice or advice in a fiduciary capacity and is not tailored to the investment needs of any specific individual or category of individuals. Opinions and examples are meant as an illustration of broader themes, are not an indication of trading intent, and are subject to changes at any time due to changes in the market or economic conditions. The information presented herein has been developed internally or obtained from sources believed to be reliable; however, neither the author nor Smith Capital Investors guarantees that the information supplied is accurate, complete, or timely, nor are there any warranties concerning the results obtained from its use. It is not intended to indicate or imply that any illustration/example mentioned is now or was ever held in any portfolio.

Past performance is no guarantee of future results. As with any investment, there is a risk of loss. Investing in a bond market is subject to risks, including market, interest rate, issuer, credit, inflation, default, and liquidity risk. The bond market is volatile. The value of most bonds and bond strategies are impacted by changes in interest rates. The return of principal is not guaranteed, and prices may decline if an issuer fails to make timely payments or its credit strength weakens. High yield or “junk” bonds involve a greater risk of default and price volatility and can experience sudden and sharp price swings.

Please consider the charges, risks, expenses, and investment objectives carefully before investing. Please see a prospectus, or, if available, a summary prospectus containing this and other information. Read it carefully before you invest or send money. Investing involves risk, including the possible loss of principal and fluctuation of value.

All indices are unmanaged. You cannot invest directly in an index. The index or benchmark performance presented in this document does not reflect the deduction of advisory fees, transaction charges, and other expenses, which would reduce performance.

This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission from Smith Capital Investors.

Smith Capital Investors, LLC is a registered investment adviser. SCI00352