Expect Market Volatility Ahead

The Federal Reserve has been walking a fine line between lagging employment and elevated inflation readings. The June FOMC meeting came in more hawkish than expected as the Fed was forced to acknowledge that inflation has indeed caught them by surprise.

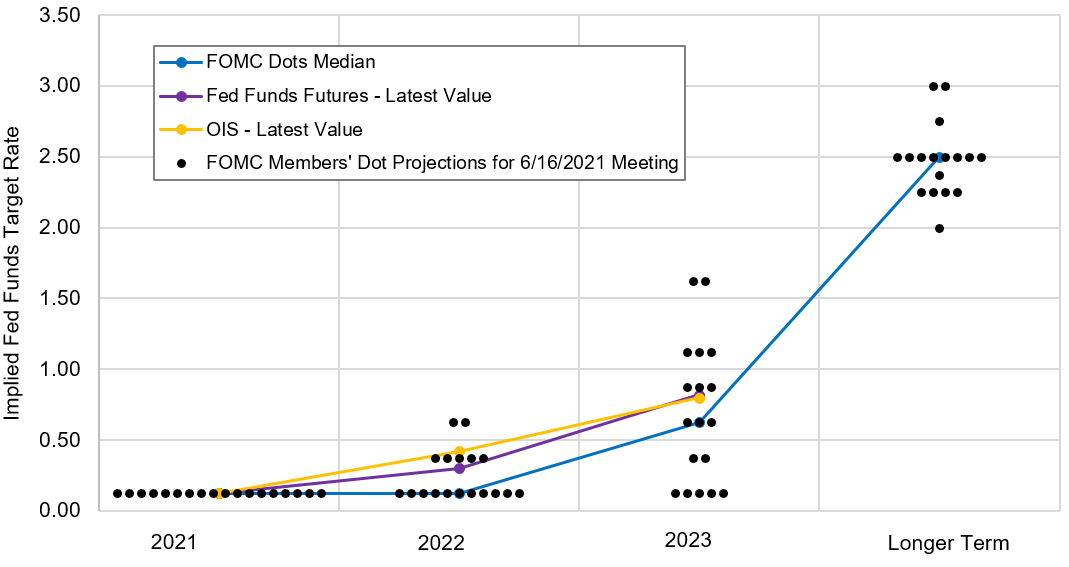

The Summary of Economy Projections, a compilation of Fed member forecasts, surprised the market by pulling forward rate hike expectations. The projections now expect two hikes to the Fed Funds rate in 2023 compared to zero in the March projection.

Federal Reserve Dot Plot

Source: Smith Capital Investors, Federal Reserve, 6/16/21

Fed Chair Powell attempted to stick with the “transitory” inflation narrative in his press conference, though acknowledged that the moves have been larger than anticipated AND the timing of when those increases will fade is uncertain as are the effects over time. Given this environment, they are prepared to adjust policy if the increase from inflation proves to be more than transitory.

Regarding tapering asset purchases, Powell also said that we should take this meeting as the official “talking about talking about tapering” and each meeting going forward is live. He noted that most committee members do believe we will make economic progress faster than expected, and he agreed that would be a welcome development, but commented we are not yet at “substantial further progress”.

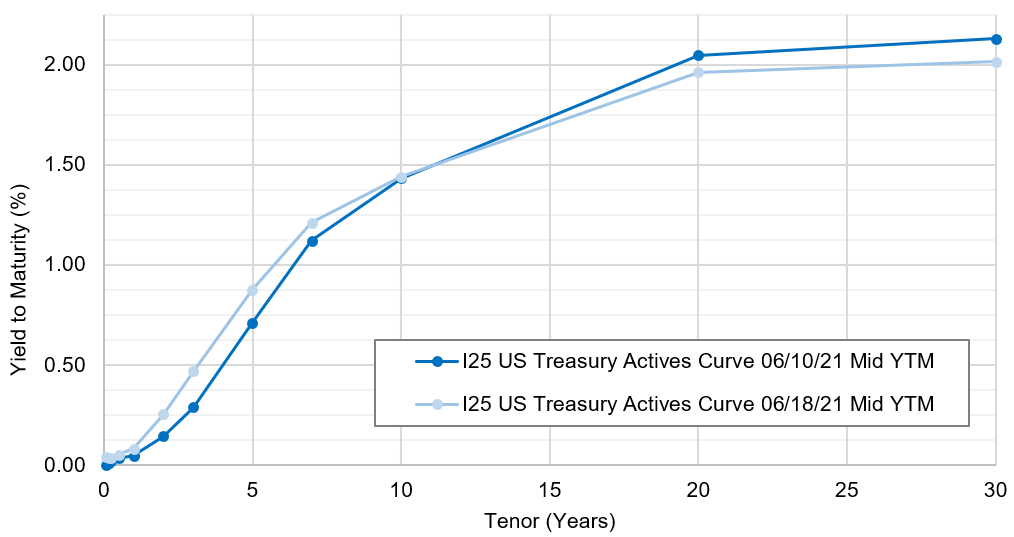

The initial market reaction saw Treasuries sell-off, however, the follow through post meeting registered a massive curve flattening as the front-end moved higher in yield on the expectations of a change in Fed policy while the long-end was pricing in policy error, rallying Thursday and Friday post meeting.

INSTITUTIONAL INVESTOR USE ONLY

U.S. Treasury Curve

Source: Smith Capital Investors, Bloomberg 6/18/21

Previously, Treasuries had consolidated and sat in a range for close to 16 weeks, but this Fed action was finally the catalyst for breaking out. The market digested the new information over the weekend and reversed price action once again on Monday. Treasuries sold-off led by the 30-yr. Between the moves last week and the sell-off Monday, the takeaway is that volatility is increasing once again which makes every economic data point and Fed meeting or communication a market moving event.

30-yr U.S. Treasury Intra-Day

Source: Smith Capital Investors, Bloomberg 6/22/21

While this acceleration of potential Fed Funds hikes has impacted Treasury valuations, we believe another large unknown of Fed policy – the timing of any asset purchase tapering – has just as much potential to impact valuations across fixed income assets.

Earlier this month, the Fed announced the unwind of the Secondary Market Corporate Credit Facility. This facility purchased corporate bonds and ETFs. The overall impact of this was minimal as the amount of assets the Fed owned (~$13bn) was minuscule compared to the broader market. However, as it relates to the Treasury and MBS markets it can be argued that given the size of purchases, the Fed has been the primary driver of valuations for both asset classes.

This is most apparent in MBS as we have witnessed MBS underperform versus its duration adjusted benchmark by almost 100 bps in the last three months. In the beginning of the year, we saw Fed purchases of MBS drive valuation levels to a point where the Fed was the only remaining buyer. As the market has slowly started to incorporate the idea of the Fed reducing its purchase activity in the MBS market, the OAS of the MBS market moved almost 25 bps wider, driving the significant underperformance. Future updates on Fed purchase activity have the potential to continue this trend as MBS spreads remain below their historical ranges.

INSTITUTIONAL INVESTOR USE ONLY

Bloomberg Barclays U.S. MBS Index Option Adjusted Spread

Source: Bloomberg 6/18/21

Bottom Line:

We have reached the point in the recovery where the Federal Reserve can begin to dial back accommodation and with that, we expect to see heightened market volatility around economic data reports as well as Fed meetings and communications. Beyond the timing of future Fed Fund hikes, any announcements surrounding reductions in the asset purchase programs for Treasuries and/or MBS have the potential to impact valuations across the fixed income market.

Let’s talk – Smith Capital Investors

Our mailing address is:

Smith Capital Investors

1430 Blake Street

Denver, CO 80202

303-597-5555

833-577-6484

info@smithcapitalinvestors.com

www.smithcapitalinvestors.com

The opinions and views expressed are as of the date published and are subject to change without notice of any kind and may no longer be true after any date indicated. Information presented herein is for discussion and illustrative purposes only and should not be used or construed as financial, legal, or tax advice, and is not a recommendation or an offer or solicitation to buy, sell or hold any security, investment strategy, or market sector. No forecasts can be guaranteed, and the author and Smith Capital Investors assume no duty to and do not undertake to update forward-looking predictions or statements. Forward-looking predictions or statements are subject to numerous assumptions, risks, and uncertainties, which change over time. Actual results could differ materially from those anticipated in forward-looking predictions or statements.

Any investment or management recommendation in this document is not meant to be impartial investment advice or advice in a fiduciary capacity and is not tailored to the investment needs of any specific individual or category of individuals. Opinions and examples are meant as an illustration of broader themes, are not an indication of trading intent, and are subject to changes at any time due to changes in the market or economic conditions. The information presented herein has been developed internally or obtained from sources believed to be reliable; however, neither the author nor Smith Capital Investors guarantees that the information supplied is accurate, complete, or timely, nor are there any warranties with regards to the results obtained from its use. It is not intended to indicate or imply that any illustration/example mentioned is now or was ever held in any portfolio.

Past performance is no guarantee of future results. As with any investment, there is a risk of loss. Investing in a bond market is subject to risks, including market, interest rate, issuer, credit, inflation, default, and liquidity risk. The bond market is volatile. The value of most bonds and bond strategies are impacted by changes in interest rates. The return of principal is not guaranteed, and prices may decline if an issuer fails to make timely payments or its credit strength weakens. High yield or “junk” bonds involve a greater risk of default and price volatility and can experience sudden and sharp price swings.

Please consider the charges, risks, expenses, and investment objectives carefully before investing. Please see a prospectus, or, if available, a summary prospectus containing this and other information. Read it carefully before you invest or send money. Investing involves risk, including the possible loss of principal and fluctuation of value.

All indices are unmanaged. You cannot invest directly in an index. Index or benchmark performance presented in this document does not reflect the deduction of advisory fees, transaction charges, and other expenses, which would reduce performance.

This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission from Smith Capital Investors.

Smith Capital Investors, LLC is a registered investment adviser.

SCI00146