Flashback to Post Financial Crisis Volatility

After nearly sixteen weeks of watching the 30-yr U.S. Treasury consolidate and bounce within a range, the Fed action in June was the catalyst needed to break out. We not only broke through the lower end of the yield range but continued to push through 2% as well. The recent rally in rates can be explained by a slew of factors: The Fed talking about tapering, the COVID-19 Delta Variant, thin summer volumes, pension buying, a short squeeze, softer macro-economic data, global yield differentials, and strong seasonals. We question if the market is now conditioned to react to bad news relating to the virus and default to a more negative outlook as a result of the uncertainty experienced throughout the pandemic.

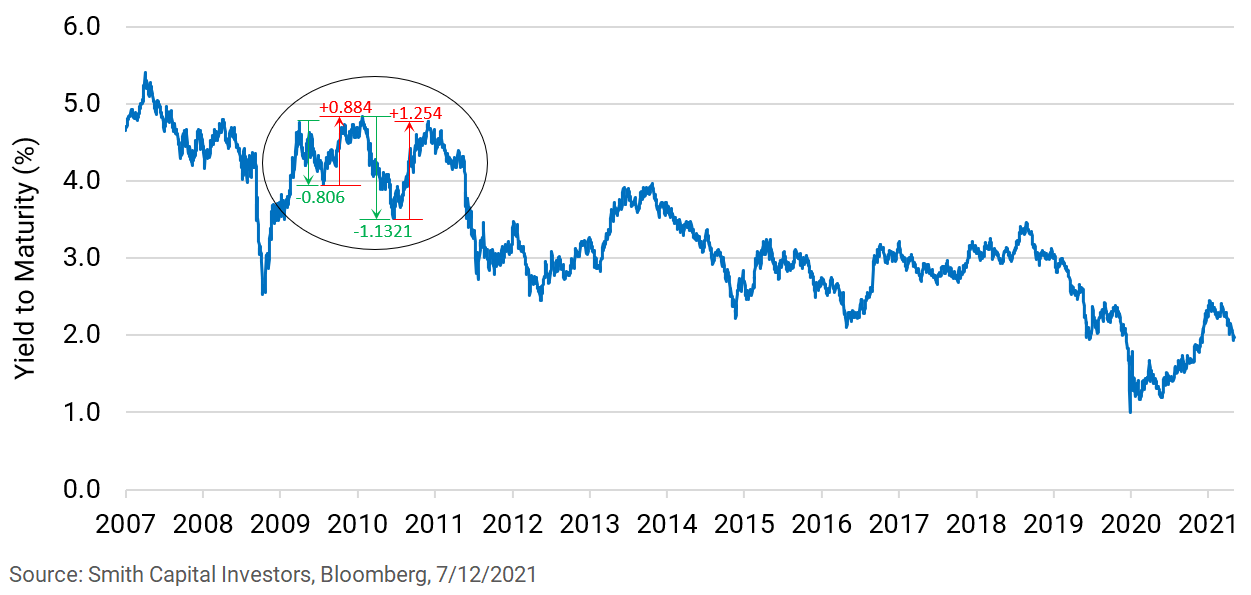

30-yr U.S. Treasury Breaks Out of the Range

Looking Back: The 30-yr U.S. Treasury during the 2009-2011 period highlights the push/pull dynamic between recovery enthusiasm and fears of recession. After a sharp sell-off in rates, we saw an 80bps rally followed by an 88bps sell-off. This was again accompanied by a 132bps rally and subsequently a 125bps sell-off. We find it interesting that the moves were very directional. We then rallied from 4.5% to 2.75% in a very swift run as the market believed we were going back into a recession, settling out around 2.50%. Keep this volatility in mind as we may see similar trading patterns in the future.

30-yr U.S. Treasury Post Great Financial Crisis

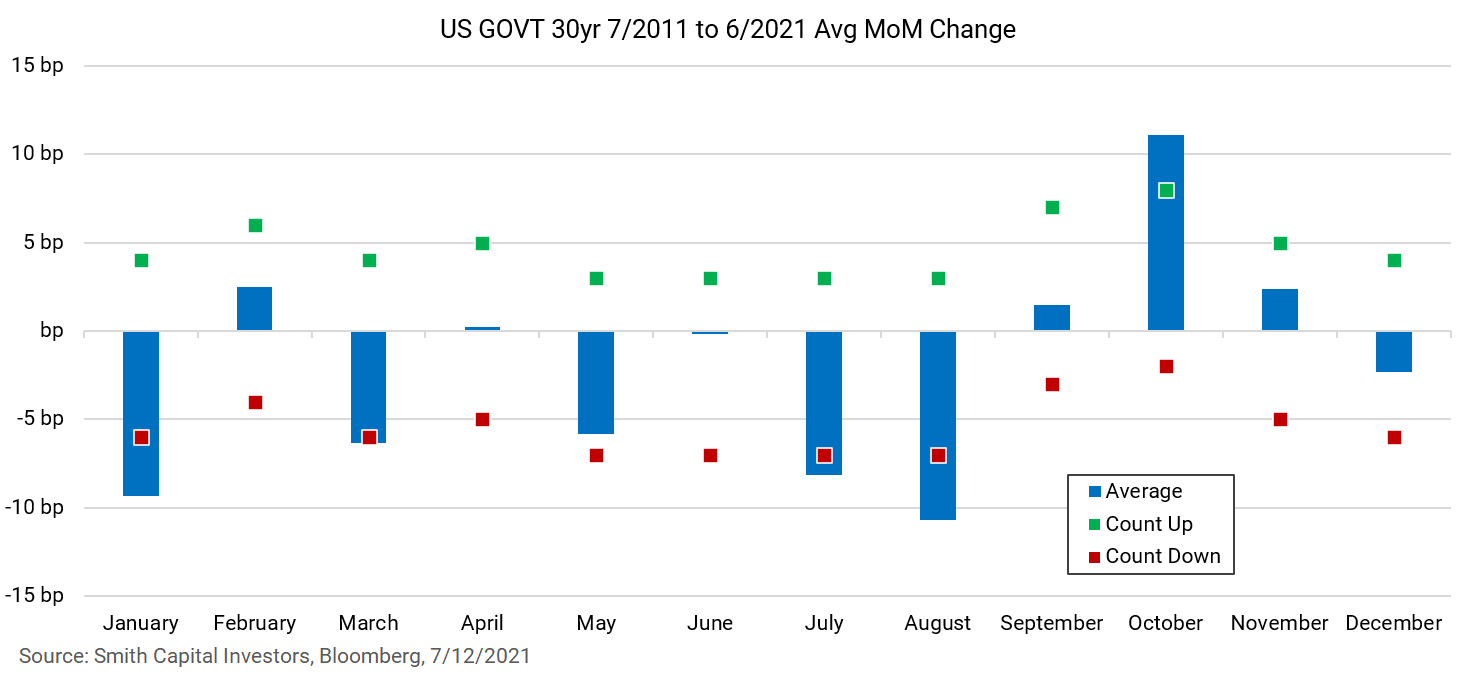

Looking Ahead: As we move forward, we will continue to have competing factors for rates. Beyond the virus ebbing and flowing and the speed of the economic recovery, we are faced with seasonals and the Fed’s future tapering of Treasury and mortgage purchases.

30-yr U.S. Treasury Seasonal

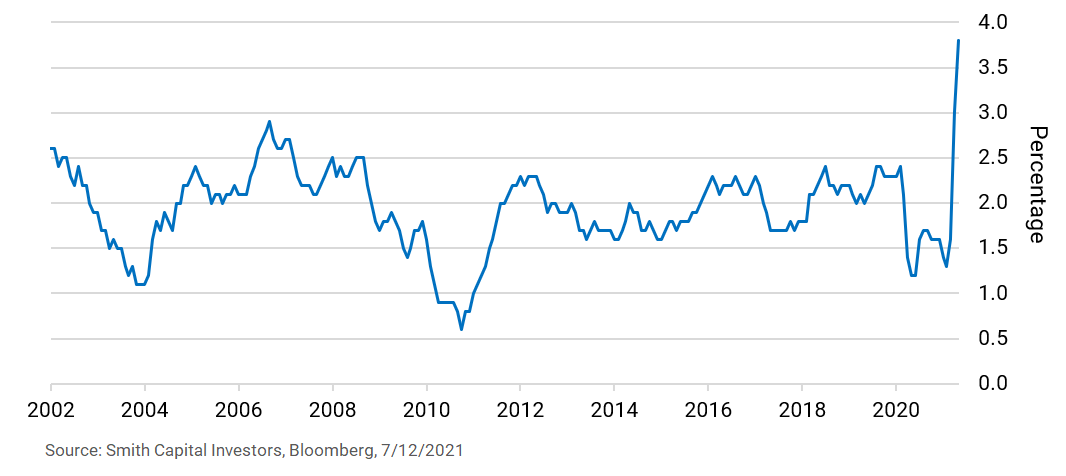

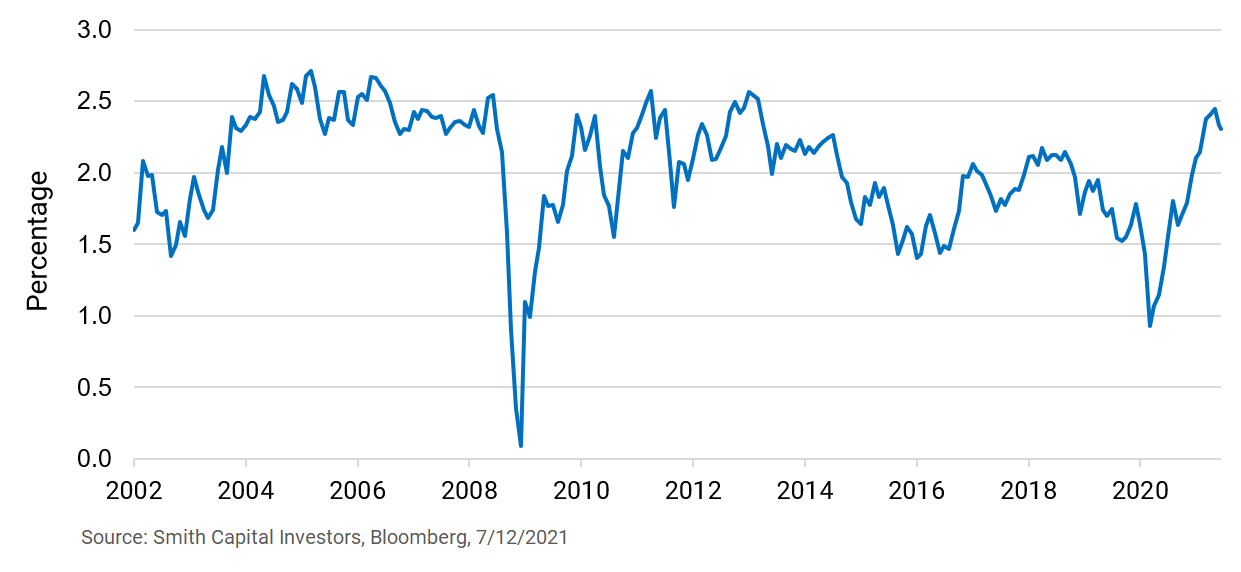

This is in addition to inflation – real as well as expectations – and throw in debt and demographics and we can quickly talk ourselves into a 2009-2011 period of rate volatility.

Core CPI YoY

10-yr Inflation Breakeven Rate

Bottom line: Volatility will be with us for some time due to contradicting market inputs. This is where patience, discipline, and active management can create great buying opportunities.

Let’s talk – Smith Capital Investors

Our mailing address is:

Smith Capital Investors

1430 Blake Street

Denver, CO 80202

303-597-5555

833-577-6484

info@smithcapitalinvestors.com

www.smithcapitalinvestors.com

The opinions and views expressed are as of the date published and are subject to change without notice of any kind and may no longer be true after any date indicated. Information presented herein is for discussion and illustrative purposes only and should not be used or construed as financial, legal, or tax advice, and is not a recommendation or an offer or solicitation to buy, sell or hold any security, investment strategy, or market sector. No forecasts can be guaranteed, and the author and Smith Capital Investors assume no duty to and do not undertake to update forward-looking predictions or statements. Forward-looking predictions or statements are subject to numerous assumptions, risks, and uncertainties, which change over time. Actual results could differ materially from those anticipated in forward-looking predictions or statements.

Any investment or management recommendation in this document is not meant to be impartial investment advice or advice in a fiduciary capacity and is not tailored to the investment needs of any specific individual or category of individuals. Opinions and examples are meant as an illustration of broader themes, are not an indication of trading intent, and are subject to changes at any time due to changes in the market or economic conditions. The information presented herein has been developed internally or obtained from sources believed to be reliable; however, neither the author nor Smith Capital Investors guarantees that the information supplied is accurate, complete, or timely, nor are there any warranties with regards to the results obtained from its use. It is not intended to indicate or imply that any illustration/example mentioned is now or was ever held in any portfolio.

Past performance is no guarantee of future results. As with any investment, there is a risk of loss. Investing in a bond market is subject to risks, including market, interest rate, issuer, credit, inflation, default, and liquidity risk. The bond market is volatile. The value of most bonds and bond strategies are impacted by changes in interest rates. The return of principal is not guaranteed, and prices may decline if an issuer fails to make timely payments or its credit strength weakens. High yield or “junk” bonds involve a greater risk of default and price volatility and can experience sudden and sharp price swings.

Please consider the charges, risks, expenses, and investment objectives carefully before investing. Please see a prospectus, or, if available, a summary prospectus containing this and other information. Read it carefully before you invest or send money. Investing involves risk, including the possible loss of principal and fluctuation of value.

All indices are unmanaged. You cannot invest directly in an index. Index or benchmark performance presented in this document does not reflect the deduction of advisory fees, transaction charges, and other expenses, which would reduce performance.

This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission from Smith Capital Investors.

Smith Capital Investors, LLC is a registered investment adviser.

SCI00160