2021 Flows Update – Cash Heavy

Thus far, 2021 has continued the 2020 risk-on mentality as vaccinations and the recovery have been the center of focus. Another hot topic is inflation; is it transitory or not? With all this going on, we are keeping an eye on fund flows in the background – essentially, how are the “votes” being cast?

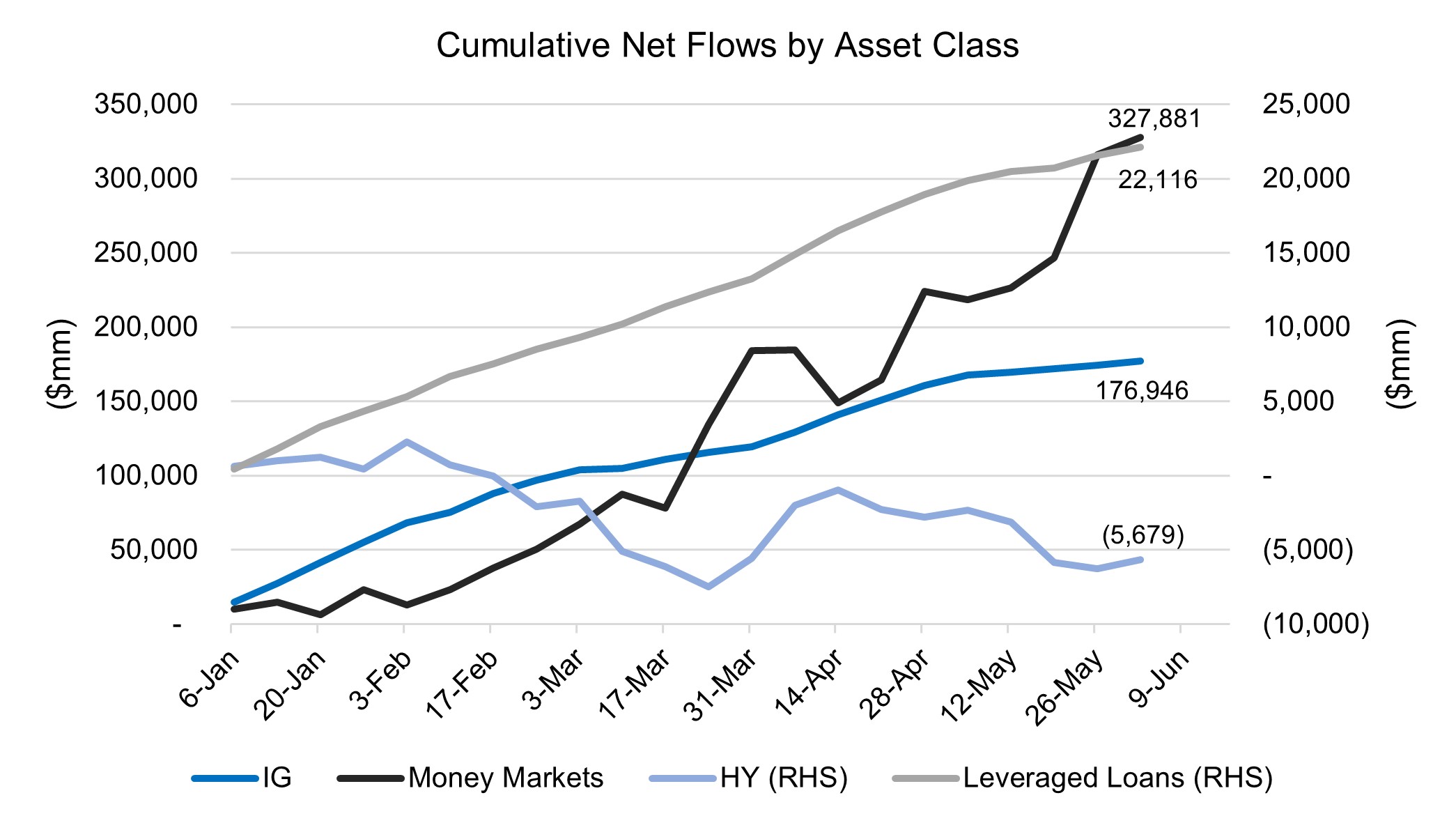

Investment Grade and High Yield have been, somewhat surprisingly, a tale of two stories thus far in 2021. The former has seen total cumulative inflows of +$176.95bn year-to-date, as of 6/2/2021. The latter has seen cumulative outflows of -$5.7bn. This has largely been attributable to two factors: a wide-open High Yield primary market that has seen $252.6bn of year-to-date new issuance (+63% y/y) and inflows to Leveraged Loans. It is likely investors are right-sizing their exposure to loans this year– which have seen inflows of +$22.1bn year-to-date – relative to High Yield. Investment Grade credit has seen option adjusted spreads (OAS) compress to +85bps while High Yield, despite the outflows, has seen spreads compress to +295bps. Each are sitting at historically-rich valuations over the past ten years – <1st percentile for IG (lowest spread) and <4th percentile for HY (9bps above the lowest spread).

Money market fund flows have been very strong in 2021 with inflows totaling +$327.9bn. This comes on the back of heavy inflows in 2020 that finished the year at +$744.8bn and peaked last May (2020) at $1.19tn. Cash on the sidelines – a topic we touched on last year – is a narrative that remains very much intact. Using history as a proxy, this cash will likely rotate off the sidelines. Following the GFC, net flows into money markets peaked in 2009 and were back to net negative by 2010.

While we continue to have a bullish view on the reopening, current market valuations are worthy of caution. Margin for error is a point we stress within our process and with credit spreads sitting at (or near) their respective tights, we’ve seen that scope narrow significantly.

Sources: Wells Fargo Securities, EPFR/Informa Business

INSTITUTIONAL INVESTOR USE ONLY

Let’s talk – Smith Capital Investors

Our mailing address is:

Smith Capital Investors

1430 Blake Street

Denver, CO 80202

303-597-5555

833-577-6484

info@smithcapitalinvestors.com

www.smithcapitalinvestors.com

The opinions and views expressed are as of the date published and are subject to change without notice of any kind and may no longer be true after any date indicated. Information presented herein is for discussion and illustrative purposes only and should not be used or construed as financial, legal, or tax advice, and is not a recommendation or an offer or solicitation to buy, sell or hold any security, investment strategy, or market sector. No forecasts can be guaranteed, and the author and Smith Capital Investors assume no duty to and do not undertake to update forward-looking predictions or statements. Forward-looking predictions or statements are subject to numerous assumptions, risks, and uncertainties, which change over time. Actual results could differ materially from those anticipated in forward-looking predictions or statements.

Any investment or management recommendation in this document is not meant to be impartial investment advice or advice in a fiduciary capacity and is not tailored to the investment needs of any specific individual or category of individuals. Opinions and examples are meant as an illustration of broader themes, are not an indication of trading intent, and are subject to changes at any time due to changes in the market or economic conditions. The information presented herein has been developed internally or obtained from sources believed to be reliable; however, neither the author nor Smith Capital Investors guarantees that the information supplied is accurate, complete, or timely, nor are there any warranties with regards to the results obtained from its use. It is not intended to indicate or imply that any illustration/example mentioned is now or was ever held in any portfolio.

Past performance is no guarantee of future results. As with any investment, there is a risk of loss. Investing in a bond market is subject to risks, including market, interest rate, issuer, credit, inflation, default, and liquidity risk. The bond market is volatile. The value of most bonds and bond strategies are impacted by changes in interest rates. The return of principal is not guaranteed, and prices may decline if an issuer fails to make timely payments or its credit strength weakens. High yield or “junk” bonds involve a greater risk of default and price volatility and can experience sudden and sharp price swings.

Please consider the charges, risks, expenses, and investment objectives carefully before investing. Please see a prospectus, or, if available, a summary prospectus containing this and other information. Read it carefully before you invest or send money. Investing involves risk, including the possible loss of principal and fluctuation of value.

All indices are unmanaged. You cannot invest directly in an index. Index or benchmark performance presented in this document does not reflect the deduction of advisory fees, transaction charges, and other expenses, which would reduce performance.

This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission from Smith Capital Investors.

Smith Capital Investors, LLC is a registered investment adviser.

SCI00142