Musical Chairs at the Federal Reserve and Interest Rate Volatility

The Federal Reserve (Fed) has been a constant pillar of stability throughout the recent economic crisis. As we near the removal of crisis accommodation (tapering Quantitative Easing), the Fed is also undergoing upheaval and transformation. The Biden administration has the opportunity in the near future to shift the makeup of the Board of Governors from a Republican majority to leaning Democratic. Additionally, what seemed like a high probability of Powell being renominated for the Chair is now less certain. The looming question for the market is whether or not Powell will have a chair when the music stops?

The current Board of Governors has five Republicans and one Democrat with one vacant seat to fill. Randy Quarles (Republican), the Vice Chair of Supervision, will see his Chair term expire in October. Quarles’ term as Governor expires in 2032 but it is undetermined if he will leave in October. Richard Clarida’s (Republican) term as Governor expires in January 2022 and Powell’s (Republican) term as Fed Chair expires in February 2022. This opens the door for President Biden to utilize his lone Democrat Lael Brainard to either replace Powell as the Fed Chair or Quarles as the Vice Chair of Supervision. Depending on Biden’s first move, he may have up to four seats to fill.

As of this week, Boston Fed President Eric Rosengren (hawk/voting member in 2022) and Dallas Fed President Robert Kaplan (hawk/voting member in 2023) both resigned due to criticism around their personal trading during the pandemic. The resignations, in combination with the possible changes at the Board of Governors level, allude to 1) a potential shift to a Democratic majority within the Board of Governors and 2) an overall dovish leaning Federal Reserve. This suggests that the timing and speed of rate hikes may be more conservative than both the Dot Plot and the market are expecting.

We believe this uncertainty is one of the reasons for the recent spate of volatility in the bond market and could be a source of volatility on the horizon.

INSTITUTIONAL INVESTOR USE ONLY

Reminders from the last Taper – Volatility

Looking back at Yellen’s term – the Fed decided to taper asset purchases followed by raising the Fed Funds Rate in a short period of time – we saw the 30-yr rally throughout tapering and then sell-off as we neared the first rate hike. The same trend occurred post the first rate hike as the market prepared for additional rate hikes (sell-off). Each period saw the 30-yr U.S. Treasury move by over 100 bps within a short timeframe.

30-yr U.S. Treasury vs. Fed Funds

Source: Bloomberg September 29, 2021

Source: Bloomberg September 29, 2021

Additionally, the Fed’s dovish leaning nature registered a historically slow tightening cycle as the “dovish” Yellen-led Fed waited one year between initial liftoff and the eventual path towards the terminal rate. In the end, the handoff to Powell marked a lower terminal rate due to market volatility. We were reminded of the market’s need for accommodative monetary policy during this period of time.

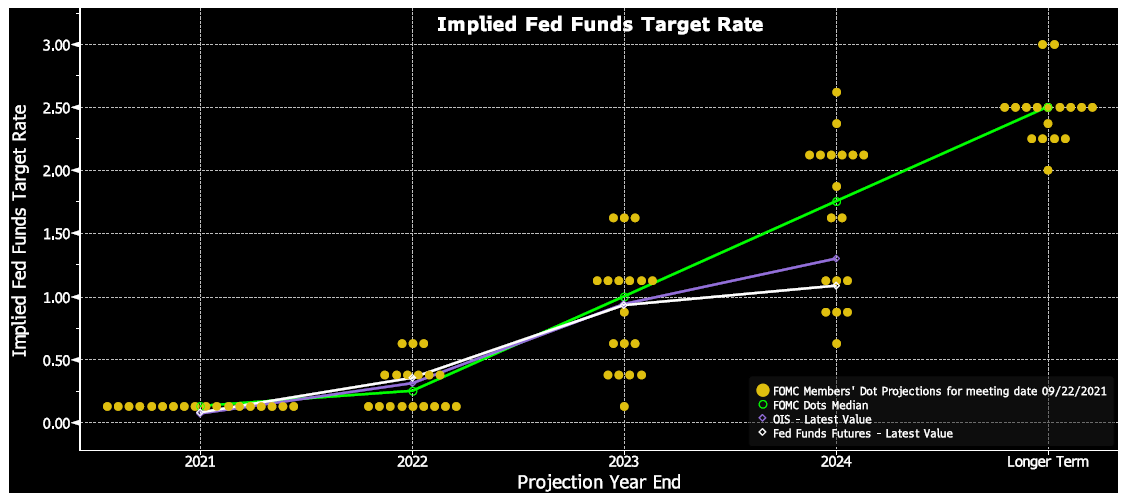

Fed Dot Plot vs. Market Expectations

Source: Bloomberg September 29, 2021

Source: Bloomberg September 29, 2021

INSTITUTIONAL INVESTOR USE ONLY

Bottom line:

The Fed is transitioning from a source of stability throughout the pandemic to a source of volatility. The combination of removing accommodation (tapering), the uncertainty within the Board of Governors and Fed Chair position, and the potential for a dovish leaning Fed moving forward suggest not only unintended market disruption and volatility but also a slower tightening cycle ahead.

Let’s talk – Smith Capital Investors

Our mailing address is:

Smith Capital Investors

1430 Blake Street

Denver, CO 80202

303-597-5555

833-577-6484

info@smithcapitalinvestors.com

www.smithcapitalinvestors.com

The opinions and views expressed are as of the date published and are subject to change without notice of any kind and may no longer be true after any date indicated. Information presented herein is for discussion and illustrative purposes only and should not be used or construed as financial, legal, or tax advice, and is not a recommendation or an offer or solicitation to buy, sell or hold any security, investment strategy, or market sector. No forecasts can be guaranteed, and the author and Smith Capital Investors assume no duty to and do not undertake to update forward-looking predictions or statements. Forward-looking predictions or statements are subject to numerous assumptions, risks, and uncertainties, which change over time. Actual results could differ materially from those anticipated in forward-looking predictions or statements.

Any investment or management recommendation in this document is not meant to be impartial investment advice or advice in a fiduciary capacity and is not tailored to the investment needs of any specific individual or category of individuals. Opinions and examples are meant as an illustration of broader themes, are not an indication of trading intent, and are subject to changes at any time due to changes in the market or economic conditions. The information presented herein has been developed internally or obtained from sources believed to be reliable; however, neither the author nor Smith Capital Investors guarantees that the information supplied is accurate, complete, or timely, nor are there any warranties with regards to the results obtained from its use. It is not intended to indicate or imply that any illustration/example mentioned is now or was ever held in any portfolio.

Past performance is no guarantee of future results. As with any investment, there is a risk of loss. Investing in a bond market is subject to risks, including market, interest rate, issuer, credit, inflation, default, and liquidity risk. The bond market is volatile. The value of most bonds and bond strategies are impacted by changes in interest rates. The return of principal is not guaranteed, and prices may decline if an issuer fails to make timely payments or its credit strength weakens. High yield or “junk” bonds involve a greater risk of default and price volatility and can experience sudden and sharp price swings.

Please consider the charges, risks, expenses, and investment objectives carefully before investing. Please see a prospectus, or, if available, a summary prospectus containing this and other information. Read it carefully before you invest or send money. Investing involves risk, including the possible loss of principal and fluctuation of value.

This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission from Smith Capital Investors.

Smith Capital Investors, LLC is a registered investment adviser.

SCI00181