5 Market-Moving Events in 2Q 2021 |

5 Events We are Watching in 3Q 2021 |

1. Recent Rate Rally |

1. Dynamic Capital Allocation |

2. Credit Back to All-Time Tights |

2. Just-in-Time to Just-in-Case |

3. The Post Pandemic Economic Cycle |

3. Inflation |

4. Leverage Shows its Ugly Head |

4. Speed of Cycles |

5. Stock-Bond Correlation |

5. Corporate Bond Supply |

Welcome to the Smith Capital Investors 5X5. We explore topics from the second quarter of the year and issues facing us in the third quarter of 2021. (Use the links above to jump to a section.)

Please find our most recent 5×5.

As always, the primary goal of this piece is to bring our clients closer to our investment process and to provide transparency into our areas of focus. In this edition, we share our view that duration and durability of the current economic recovery will be more robust than the consensus, sharing our thoughts around interest rates, inflation, asset prices, capital market flows, and more. While our view of a stronger, longer, and potentially more durable recovery are a central theme, we see risks in being too wed to this view. As confidence and confirmation around the recovery accelerates, we see opportunities for this theme to gain greater momentum in the marketplace.

One of the residual outcomes of greater confidence in the recovery will be the return of shareholder-friendly activity. Increased dividends, share repurchases, mergers and acquisitions, and more aggressive investment seem like logical outcomes. However, we could also see a wave of deleveraging from both accelerating growth and focused debt reduction. The focus on efficiency and productivity during the pandemic should feed higher margins, greater free cash flow generation, and a lot of optionality for management teams.

Our ongoing belief in mini-cycles and the speed of capital deserves some attention. Not a day goes by without confirmation of these themes. The relationship between stocks and bonds will be an ongoing focus as well. We find this to be one of the more important considerations in thinking about risk management and managing through these dynamic markets.

We hope you find the insights from the investment team to be helpful to your process. We are happy to get on the phone and discuss any of these topics in greater detail.

We find ourselves defaulting to our three pillars when launching the firm – Investment Excellence, Relationships/People and Intentional Culture and are always looking for ways to improve in these areas. We welcome feedback around how we can improve our communication and our content.

With great appreciation and gratitude,

The Smith Capital Team

FOR INSTITUTIONAL INVESTOR USE ONLY

5 Market-Moving Events in 2Q 2021

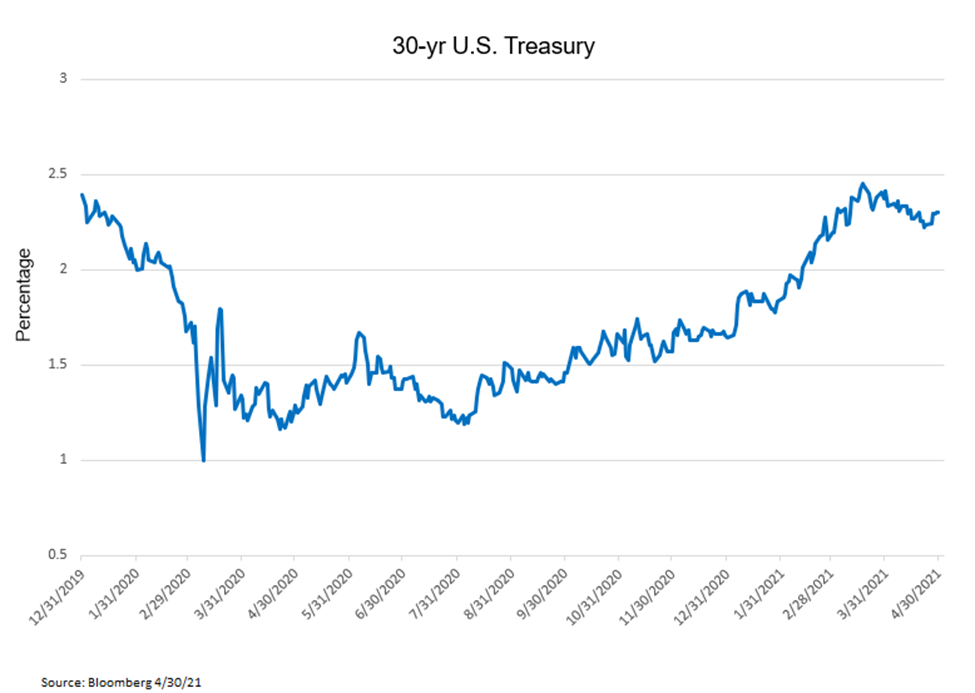

1. Recent Rate Rally

In normal fashion, price action from U.S. Treasuries was ahead of the market in the first few months of the year, providing a healthy reminder that recovery was indeed in our future. After a fast and furious sell-off in U.S. Treasuries (yields moving higher), rates rallied before finally reaching a point of consolidation by mid-March. There are many reasons for this pause as noted in the bullet points below. Similar to the move higher in yields reflecting a healthy confidence in the future recovery, the recent pause also reflects a healthy repricing of risk-free assets. The timing however did not necessarily line up with the positive momentum from the economic data (remember economic data does lag) and therefore was a good reminder this leg of the recovery is priced into the market and we are now in the validation phase. While in the validation phase, active management of duration and curves becomes even more important.

- U.S. Treasury yields moved higher in a fast and furious manner starting with the ‘blue wave’ results in January. This was further supported by the efficacy of the vaccine, additional fiscal stimulus, and prospects of economic reopening, all pointing to improving growth and inflation expectations. The street upgraded growth forecasts, inflation expectations rose, and the market challenged the Fed’s view they would be able to control inflation.

- In an interesting turn of events, Treasuries started to rally and then consolidate right as the economic data was gaining positive upward momentum. This suggests a good amount of positive news was already priced into the Treasury market. This was not the entire story however as a collision of forces including fatigue, short-covering, global tensions, demand from Japan, pension buying, and the fourth wave from COVID globally likely all impacted Treasury demand.

- The fundamental thesis remains intact: we are reopening, pent-up demand is being unleashed, the vaccine is being distributed, and we will continue to have supportive fiscal and monetary policy. That being said, the rally reminded us we still live within a two-steps forward, one-step back environment. The virus remains a risk, and there is always a possibility the market will disconnect from the Fed, or inflation, debt, and deficit fears will rise once again.

BOTTOM LINE

After the quick one-way move higher from yields, we are back in a normalized trading environment. This requires both offense and defense, which we like to call active management. Our thesis around returning to positive real rates due to a supportive reopening and strong recovery remains well intact. We ask ourselves what a stronger, longer, and more durable recovery would mean for interest rates, but also question the risks associated with any perception of permanent scarring and less stability in the recovery. We strongly feel we are in the validation phase of the recovery which allows for more two-way flows in the Treasury space, creating new opportunities.

FOR INSTITUTIONAL INVESTOR USE ONLY

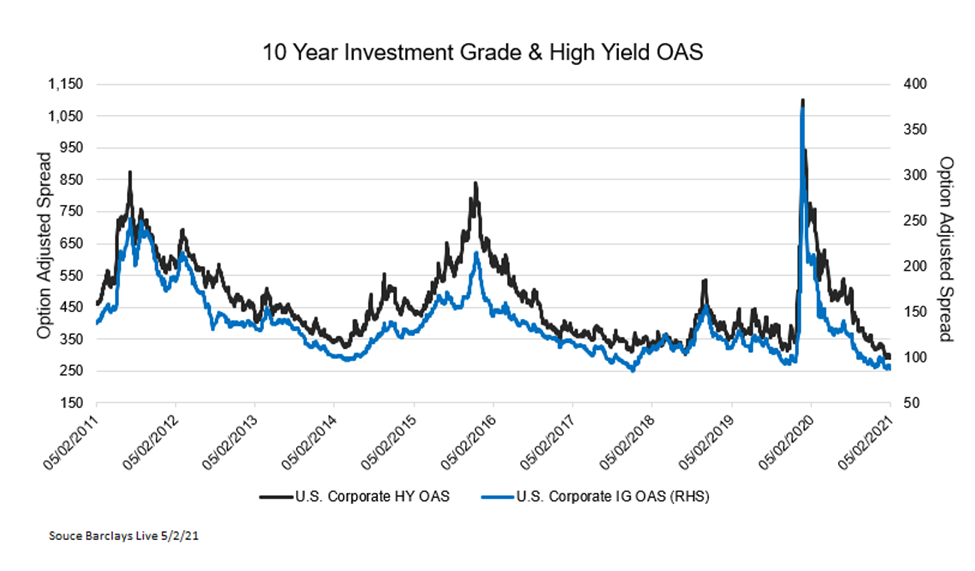

2. Credit Back to All-time Tights – Will This Time be Different?

We have spoken at length about the valuation backdrop for corporate credit. At the time of this writing, the Bloomberg Barclays U.S. Corporate Investment Grade and High Yield Indices are trading at or near record-low option adjusted spreads (OAS) over the trailing 10-year period. As students of history, we are cognizant that investing new capital at record-low valuations has not been a great formula for generating strong future returns. That said, history does not always repeat itself and our job as investors is to navigate the current risk-versus-reward environment as effectively as possible. In that vein, we find ourselves focusing on the drivers of current credit valuations and the durability of these factors.

- Without a doubt, the strongest driver of spread tightening over the past year has been accommodative monetary and fiscal stimulus. Looking forward, the Fed appears unlikely to shift its accommodative stance unless underlying economic data trends move sharply above current expectations. The outlook on the fiscal side is less clear, but the economic impact of a sustainable recovery led by large-scale infrastructure spending may offset the impact of a higher tax drag.

- Another powerful driver of performance has been the economic rebound that is taking place following the sharp declines of early 2020. The fundamental outlook for corporate earnings has been improving, not only due to this resurgence in activity but also due to the adoption of leaner and more efficient operating models that are largely expected to drive higher margin profiles in the future. The improving outlook appears to have some runway given strong consumer confidence, the highly liquid corporate and consumer balance sheets that exist today, as well as the potential for pent-up demand being unleashed across a number of industries as COVID-related restrictions are eased.

- The above factors have created a strong technical backdrop for corporate credit, with significant inflows driving elevated buying activity. While historically tight valuations may impact future flows, other factors driving inflows into corporate credit remain in place – namely the need for yield in a yield-starved world and the relative attractiveness of U.S. corporate credit versus other alternatives.

BOTTOM LINE

Will valuations revert toward the mean or are materially tighter spreads justified? At least two of the above drivers of valuations are likely to remain in place – easy monetary policy and a continued rebound in corporate earnings. As long as these factors remain supportive, any sell-off in corporate credit could be short-lived and spreads could remain tight. However, with historically low prospective returns and record long durations, credit is vulnerable to a sell-off if any of the above trends were to reverse. While we are unable to predict what may cause spreads to widen, we believe caution is warranted as the cost of being too defensive (foregoing upside) seems to be much less than being too aggressive (failing to protect capital).

FOR INSTITUTIONAL INVESTOR USE ONLY

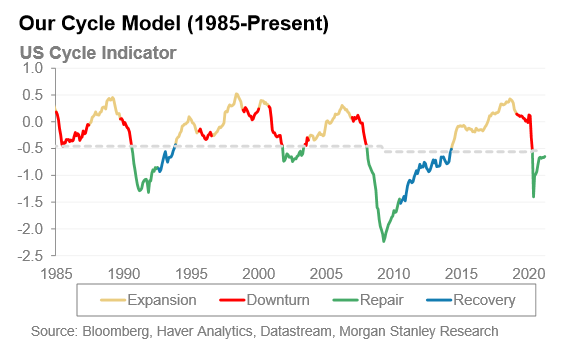

3. The Post Pandemic Economic Cycle

The pandemic ushered in many firsts as well as creative adaptations from businesses and policymakers alike. We did not have the luxury of time due to the rapidly unfolding pandemic and therefore expedited global responses across government and fiscal agencies were necessary. Similar to the increased speed of response and adaptations, we have watched a quick snapback, likely truncating the length of a normal cycle.

- The pandemic halted what The National Bureau of Economic Research (NBER) declared as the longest expansion on record, lasting 128 months. As we entered the pandemic-led recession, completely closing our economy, policymakers brought unprecedented levels of stimulus, currently totaling $5.3 trillion on the fiscal side of the ledger. The Federal Reserve also lowered front-end rates to zero and provided a broad range of measures to support households, employers, state and local governments, as well as financial markets. The quick and targeted response allowed for a robust economic snapback, laying the groundwork for what could be a shorter economic cycle.

- Concurrent with stimulus being implemented, businesses adapted, quickly focusing on efficiency and productivity, utilizing technology, and shoring up balance sheets. Innovation has become an even more important focus for all companies. The cheap financing put many companies in a position to not only survive, but thrive, into the economic reopening. While not perfect, the support to businesses and individuals has allowed for a quicker recovery than previous recessions.

- Across a wide range of economic and market-based indicators, many have not only recovered, but have also accelerated beyond pre-crisis levels. This suggests the fiscal and monetary support did its job. But….we are now faced with massive amounts of liquidity in the system, a highly accommodative Federal Reserve, and a booming economy (by many measures). Could the unintended consequences of aggressive fiscal and monetary policy become the recipe for excess risk-taking in what will likely be a shorter economic cycle? We ask ourselves this question daily.

BOTTOM LINE

Many companies and individuals are coming out of the recession with strong balance sheets into an economic reopening with continued fiscal and monetary support. Fears of potential bubble formation and the risk of future inflation are very relevant, especially as the recovery gains momentum. The increased risk-taking due to the massive amounts of liquidity in the system is fueling very healthy, if not full, valuations and not leaving a lot of room for error. It is prudent to recognize the pandemic was an exogenous shock with a quick response and therefore may indeed lead to a shorter cycle than previous periods. We feel strongly in our thesis around mini-cycles and the speed of capital in the system.

Morgan Stanley Cross Asset Strategy April 19, 2021

Morgan Stanley Cross Asset Strategy April 19, 2021

FOR INSTITUTIONAL INVESTOR USE ONLY

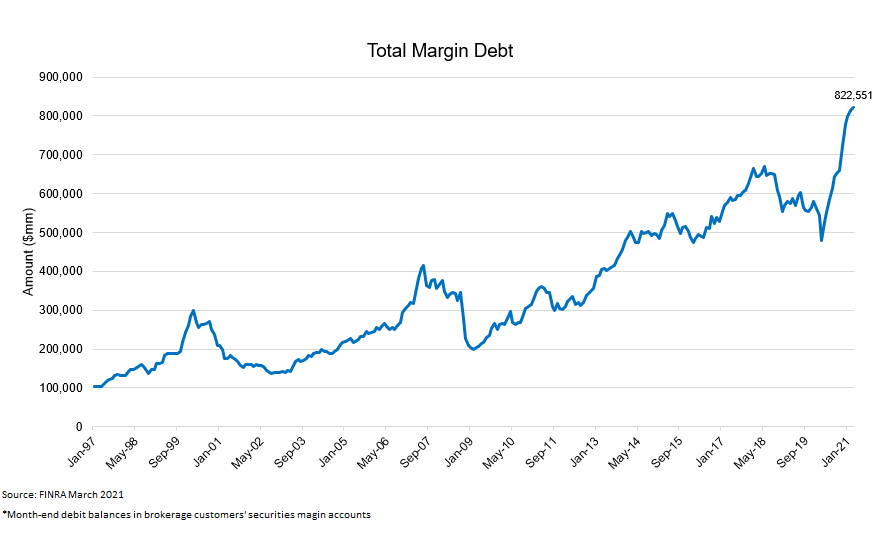

4. Leverage Shows its Ugly Head

Well, that didn’t take long! In our last “5X5” we talked about rampant speculation in the markets (“Investing in the Era of SPACulation”) and the potential for the market gods to seek payback. The Archegos situation highlights the risk of leverage in the system. But even with market gods taking a victory lap, the size and victims of the losses grabbed our attention.

- For a previously under-the-radar entity to cause $10 billion of pain in vanilla securities is mind-boggling and will rank with some others in the great Losses Hall of Shame. Exotic derivatives? No. Emerging markets? For the most part, no. Leveraged fixed income? No. Listed equities? Yes. Wow!

- On the one hand, this is a good reminder that what hurt the markets in the past rarely repeats itself (at least sequentially), as risk managers clamp down on the cause of the last catastrophe (risky mortgages and credit derivative counterparty risk post-GFC) and are lazy about new risks with investment banks chasing the next new high ROI “what could go wrong” business. And on the other hand, it has to be acknowledged at its core, this is yet another example of leverage gone bad.

- When asked directly in his most recent press conference, Fed Chairman Powell dismissed the notion of excessive leverage in the system and pointed to the benefits easy monetary policy has had on household balance sheets. Fair enough, but the yellow flags are still there.

BOTTOM LINE

Large losses always have a lasting impact on risk-management practices. We suspect even if there aren’t further shoes to fall here (though there may be), behavioral shifts on Wall Street will result in further risk capital bleeding out of the equity markets and likely influence risk tolerance in other asset classes as well. Expect prime brokerage providers to tighten up terms on their clients, and in cases where existing equity swaps need to be rolled with any client, it would be safe to assume less leverage will be allowed. This may be a marginal headwind for equities, but the broader point relates to the risks of the speculative environment we are in.

We are keeping an eye on leverage in the system. When expected returns are low and leverage is high, volatility usually serves as the great regulator. Note we did not mention crypto.

FOR INSTITUTIONAL INVESTOR USE ONLY

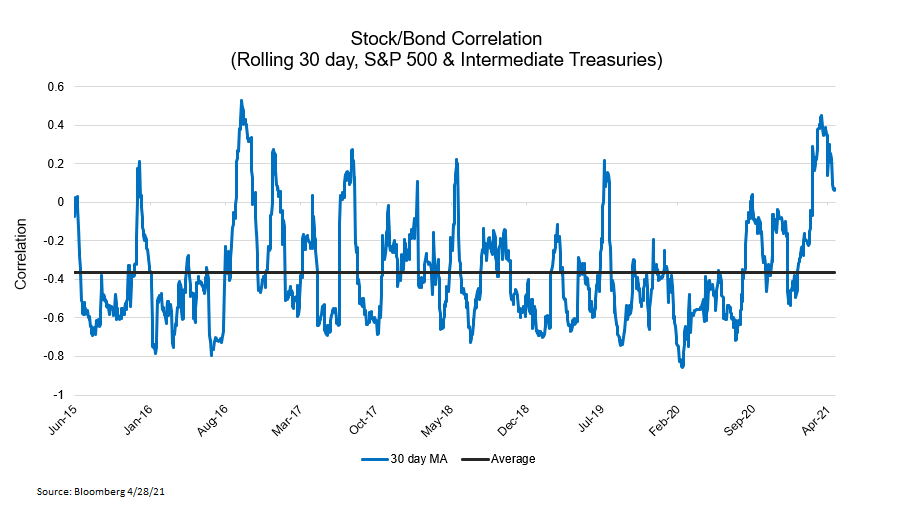

5. Treasury Sell-off Pushes Stock-Bond Correlation to Positive

Over very long periods of time, stocks and bonds have displayed a positive correlation, which academics would attribute to the discount rate driving the value of a corporation’s cash flows and hence, stock price. However, since the late 1990s, stocks and bonds have been negatively correlated, driven by flight-to-quality characteristics of bond prices. This has been a form of nirvana for investors, as both bonds and stocks produced solidly positive returns in the historic context of the market while the negative correlation between the asset classes reduced portfolio volatility.

- Similar to the rate sell-off in the second half of 2016, as the Treasury market sharply sold off in the first quarter of 2021, the stock-bond correlation turned positive. Higher rates, and perhaps more importantly the pace of the move, weighed on equities and pushed both markets down (at times) and flipped the correlation to positive.

- This reminds us of the positive tailwind that rates (and easy monetary policy) were for equities during 2020 and indeed for the last twenty years, as sell-offs rarely upset the gravitational pull of the zero-bound and allow stock investors to discount cash flows at ever lower rates.

- If it is inevitable that rates are headed higher (granted it is not), spurred by increases in real rates, inflation (real or perceived), or both, we could be entering a completely different correlation regime than investors have experienced the last twenty years, but one that would be consistent with the long-run history of markets.

BOTTOM LINE

Meaningful upward shifts in interest rates have been few and far between for most of today’s market participants. If the strength we see on the horizon for the economy and the inflation outlook plays out close to expectations, investors could be exposed to bond market weakness bleeding into risk assets, causing mark-to-market pain but also drawing broader questions regarding portfolio construction in an era of positive stock-bond correlations.

We view the recent back up in rates and a return to positive real rates in the long end of the market as very healthy. Watching the correlation and relationships between bonds and stocks is absolutely critical today.

FOR INSTITUTIONAL INVESTOR USE ONLY

5 Potentially Market-Moving Events We are Watching in 3Q 2021

1. Dynamic Capital Allocation: Options and Implications

Capital allocation is always important. It is crucial from management’s perspective (inside investor) and just as critical from our perspective (outside investor). Our team discusses it frequently – monitoring its pulse from both a high level and at the individual company level – and is both prioritized and revisited often.

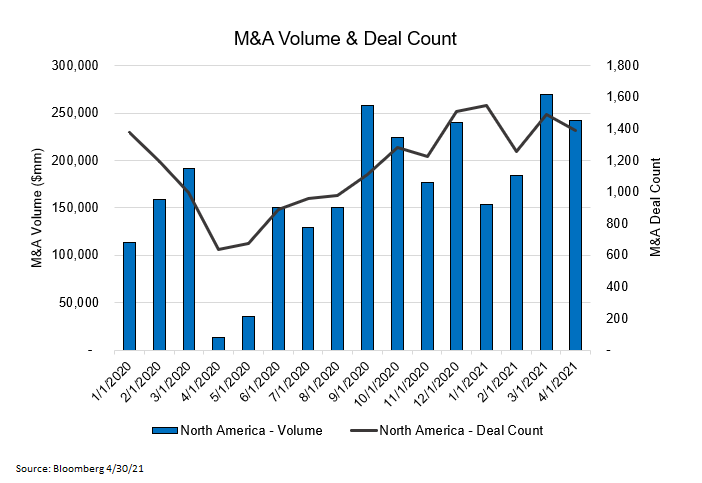

Over the course of the past year, enormous amounts of liquidity were raised and/or preserved in the face of surfacing uncertainty. For some companies, liquidity stockpiling proved necessary. At other companies, it is proving to be a wise cautionary step, but perhaps also excessive. With excess, underpinned by increasing assurance of a better future, often comes optionality. As we look out over the next few months, we continue to believe the already hastening pace of M&A, dividend increases, new share repurchase authorizations, etc. will quicken. Understanding how changing capital allocation decisions can impact a creditor is important from our perspective. Additionally, sifting through and understanding the nuances will be key.

Across the capital allocation spectrum:

- In March Nordstrom (JWN) raised unsecured financing to repay secured debt it issued last year. From a capital allocation perspective, calling its secured bonds accomplished three things: 1) freed up valuable collateral, 2) extended a portion of its bond maturity profile, and 3) lowered its average coupon cost. These actions, afforded by increasing optionality, similarly free up vital flexibility and resiliency for the future. We believe others will follow this strategy too.

- With very strong capital generation, decreasing expectations for future losses, and more confidence in the future, OneMain Financial announced with its earnings release it would be increasing its quarterly dividend by over 50% as well as authorizing a new share repurchase program. Outside of positive signaling, a return of excess liquidity to shareholders comes due to comfort in a stronger balance. This said, however, given the sticky nature of a dividend and looking out to the next unknown crisis, dividends can become a burdensome hindrance to future financial flexibility and resiliency.

- In March of last year, there was zero M&A-related debt issuance. Last month, Credit Suisse noted it expected $35bn of M&A-related debt issuance, more than any month in the prior two years, with approximately 50% of it for Leverage Buyout (LBO) financing. As it pertains to creditors, LBOs can have a material impact on a company’s credit profile, usually resulting in heightened risk to creditors from more aggressive capital structures.

BOTTOM LINE

As we are currently working through the 1Q21 earnings season—we are getting more and more confirming data points that corporate confidence is increasing. And, with that, we see shifting capital allocation decisions, which we would characterize broadly as a transition from defensive optionality to offensive optionality. Ultimately, we monitor the changing of these tides because we believe there are real investment implications behind the swells – investors who can successfully navigate the changing risk versus opportunity landscape can create better outcomes over time.

We also see management teams that will use excessive liquidity and capital to right-size their capital structures via debt reduction and/or cleaning up short-term maturities. As we move into a more shareholder-friendly environment, we are reminded of the importance of security selection and, more importantly, security avoidance.

FOR INSTITUTIONAL INVESTOR USE ONLY

2. Just-in-Time to Just-in-Case

The investment landscape of the last several decades has been often dominated by the inter-related phenomena of globalization, disinflation, and China’s rise to economic prowess. Global capital flows benefited from easier access to cross-border investment, companies took out massive costs, Asian economies rose in prominence, global interest rates continued their long march lower, and, barring the occasional global speculative blow-off and reversal, equity markets were strong. In response, wealth inequality increased, nationalism rose, and the political environment in the West shifted dramatically. But the shift in the White House and the supply chain dependencies exposed by the pandemic will have far-reaching impacts on capital flows, the economy, and markets.

- Expect corporate America to reverse decades of supply chain optimization driven by a “Just in Time” mentality to a more risk management driven approach of redundancies, investment in U.S. capital infrastructure, and higher inventories – “Just in Case.”

- The Biden Administration has targeted onshoring of jobs as a core part of its economic agenda and seems willing to entertain industrial policy as a means to get there. This has both the traditional challenges associated with politicians picking winners and losers, but will also have knock-on implications for immigration policy, tax policy, environmental regulations, and beyond.

- Companies will likely find it very difficult to disentangle supply chain and business arrangements set up over multiple decades and by no means are going to turn their backs on the giant China market, but the events of the last year and the political environment will provide a continued push towards onshoring of employment and capital spending.

- These developments could put upward pressure on prices for goods, both from a demand perspective (restocking) and input costs, while U.S. corporations moving people, plant and equipment back onshore will have positive impacts on growth that could lead to a more lasting, more robust, economic recovery scenario. The bond market is going to have a lot to contend with as this theme plays out.

BOTTOM LINE

U.S./China relations, the related policy initiatives and private sector response will be a pivotal checkpoint for investors in the balance of 2021. These two engines of growth for the global economy will be undergoing a giant course redirection in contrast to the trends investors have been exposed to for over twenty-five years.

FOR INSTITUTIONAL INVESTOR USE ONLY

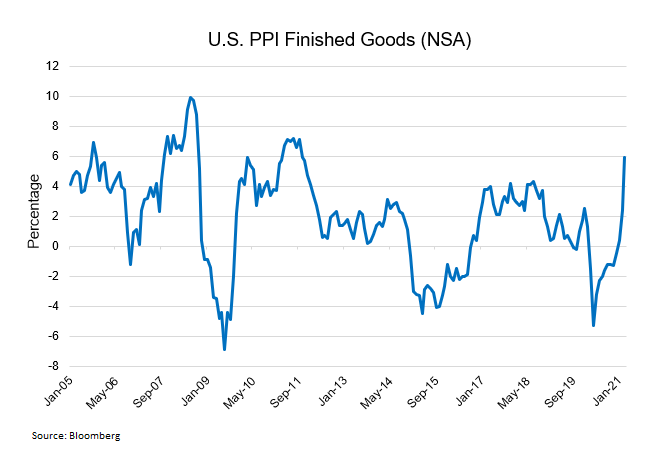

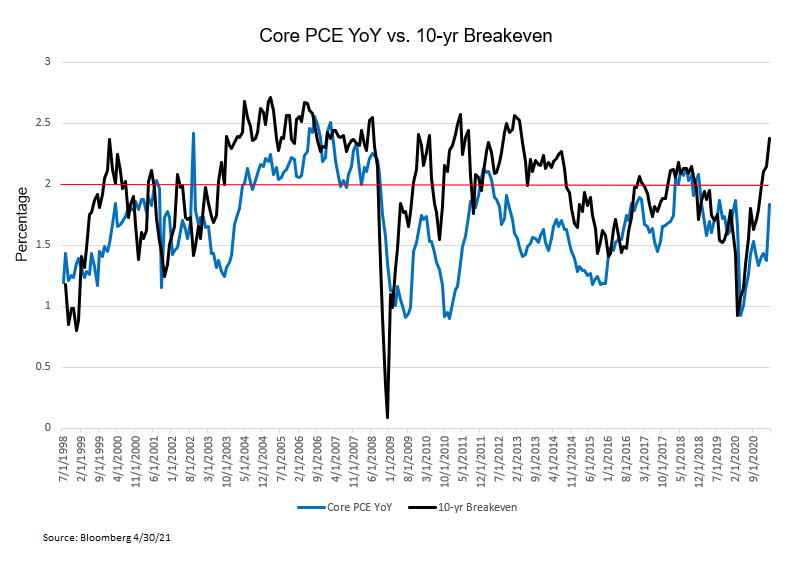

3. Inflation – Expectations, Reality, and The Fed

Inflation has been on the market’s mind since the election in November 2020 and the “Blue Wave” in January of this year. Reopening an economy and unleashing pent-up demand with the combination of massive fiscal policy and a highly accommodative Federal Reserve is not only a great economic experiment, but one ripe with risks. The market spent much of the first quarter assessing if the result of this experiment will end in significant inflation. The concerns around higher inflation are not without merit given the inflation around us in our everyday life. But the Fed, and thus far the data, suggest the upcoming inflationary pressures will be transitory due to rebasing, reopening, and bottlenecks that prove transitory. Given we have not achieved sustainable inflation for many decades, the Fed does have history on its side.

- The market is “feeling” inflation. Inflation expectations via the Fed’s 5yr-5yr forward inflation expectation rate, are back to levels from 2014, the 10-yr breakeven rate is back to 2013 levels. The University of Michigan’s 1-yr ahead inflation expectations is back to levels from 2012. Consumers and businesses are “feeling” inflation whether it be home prices, raw materials, food, or energy.

- The reality is, we do have pockets of inflation – the combination of the recovery and the base effect will temporarily lift inflation before we normalize into the end of 2021. We know the supply/demand imbalance due to the pandemic did impact categories differently. Vehicles and appliances cost more but lodging and airline fares fell dramatically. Anecdotally, companies are either passing prices along to the consumer or taking a hit to margins. But the real story lies with labor. Finding and hiring qualified workers remains a challenge across many industries suggesting wage increases lie on the horizon. That being said, as more individuals are hired, we work through supply chain issues, and the economy is fully reopened, inflation could normalize and even turn higher.

- The Fed’s stance: Temporary price increases are transitory due to the “base effect” and “bottlenecks” in the supply chain. Powell stated “If inflation were to move persistently and materially above 2%, the Fed would use its tools to bring inflation down…. We understand our job…. No one should doubt the Fed would move to contain inflation.” In the meantime, “With inflation running persistently below this longer-run goal, the Committee will aim to achieve inflation moderately above 2 percent for some time so inflation averages 2 percent over time and longer-term inflation expectations remain well anchored at 2 percent.”

BOTTOM LINE

There are pockets of inflation, and similar to the shape of the recovery, inflation remains uneven across categories. The combination of returning demand and the base effect will temporarily lift inflation in the coming months, but we expect this to normalize as we reach the end of 2021. Both the consumer and the market “feel” inflation and believe that the Federal Reserve will be behind the curve at the onset of inflation. However, it’s important to remember that Core PCE has averaged 1.93% YoY going back to 1990, allowing the Fed the flexibility to let inflation run above their 2% mandate while employment recovers.

We remind investors that longer term inflation is largely driven by aggregate demand versus aggregate supply, but changes in short term expectations can have significant impact on valuations in both stocks and bonds.

FOR INSTITUTIONAL INVESTOR USE ONLY

4. The Rapid Increase in the Speed of Cycles – Interest Rates

We have highlighted numerous times, two of our key beliefs are: 1) investment cycles are getting shorter and shorter given the speed of capital and amount of liquidity in the system, and 2) the direction of rates and the shape of the interest rate curve are the key risk factors in today’s fixed income markets. The violent move higher in longer duration U.S. Treasury yields during the first quarter only serves to highlight the overlap of these themes.

As we look forward to the balance of the year, we are spending extensive time thinking about the overlap of these themes and how these factors will drive returns and losses.

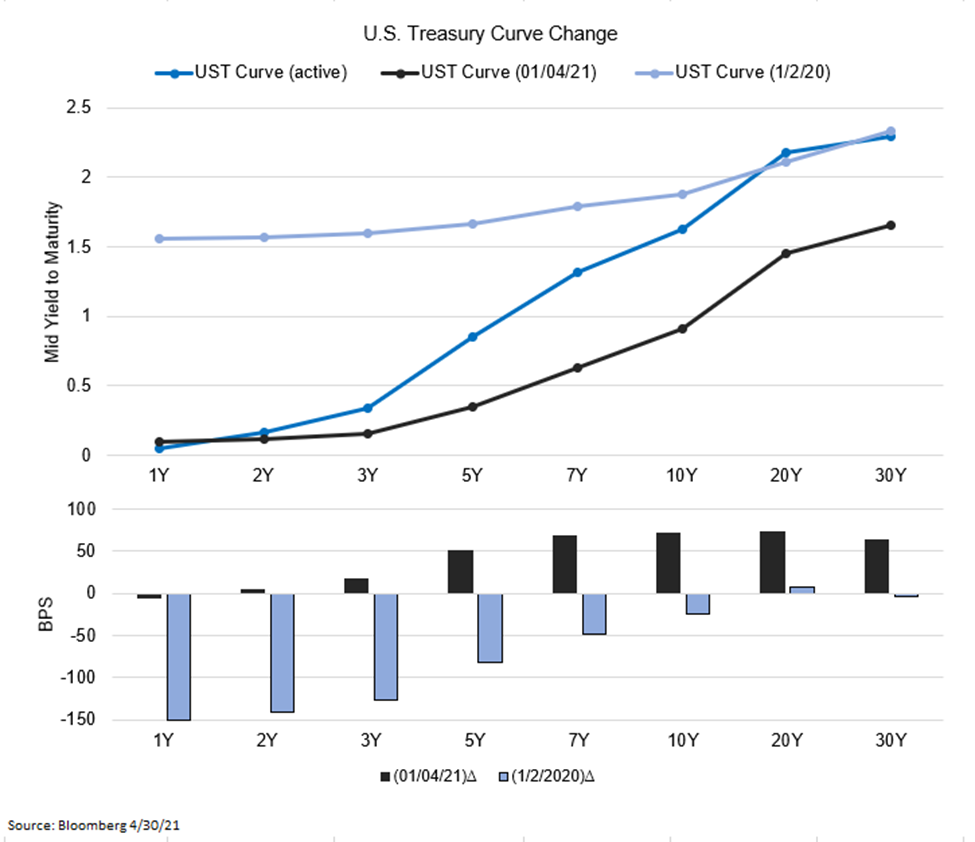

- The dramatic increase in longer-duration interest rates back to pre-pandemic levels led to significantly negative returns in U.S. Treasuries; yet, it also created the potential for positive real yields (at or above projected inflation levels) for the first time in a year. Positive real rates are historically a significant tailwind to future fixed income performance. On the flip side, yields for the front end of the Treasury curve remained pegged by the Fed’s accommodative stance at near pandemic and multi-year lows. This dynamic drove a massive steepening of the interest rate curve.

- Looking forward, there are numerous crosscurrents at play that will continue to impact the shape of the interest rate curve as well as the overall level of interest rates. We face continued deficits and the need to finance them via increasing government debt issuance. Both fiscal and monetary policy stimulus is set to continue, supporting the reopening and ongoing growth. Additionally, inflation pressures continue to grow as economic data dramatically improves with the fits and starts of reopening the domestic economy.

- Chairman Powell has maintained his position of keeping monetary policy loose and rates low to support the fledgling economic recovery. He has also referenced a desire to support the low-end consumer who has largely been left behind in the last 12 months. That, combined with the previously mentioned positive real rates, an investing world starved for yield, and the relative attractiveness of U.S. yields compared to developed economy yields globally might serve to provide a limit on how high yields will move.

- With massive amounts of money searching for yield as well as allocations to short duration fixed income as a “safe haven” trade against higher rates, we expect additional clarity on the issues above will drive outsized market moves compared to historical periods. Consider the chart below where we show the change in outright yields as well as the shape of the curve over a YTD perspective as well as versus pre-pandemic levels. These 3-month and 15-month periods have seen massive moves in both factors creating risk and opportunity for investors.

BOTTOM LINE

In an environment of fast and violent market moves, the importance of active management cannot be overstated. When we think about how we construct our portfolios, managing this risk is a primary consideration. Looking at yields in today’s fixed income markets, we see numerous scenarios as a catalyst to drive outsized moves in valuations, both to the positive and the negative. Positioning for these requires a deep understanding of the market and the dynamics at play. We see the need for a disciplined and nimble approach as we navigate markets for the balance of the year.

FOR INSTITUTIONAL INVESTOR USE ONLY

5. Corporate Bond Issuance – Will There Be a Second Act?

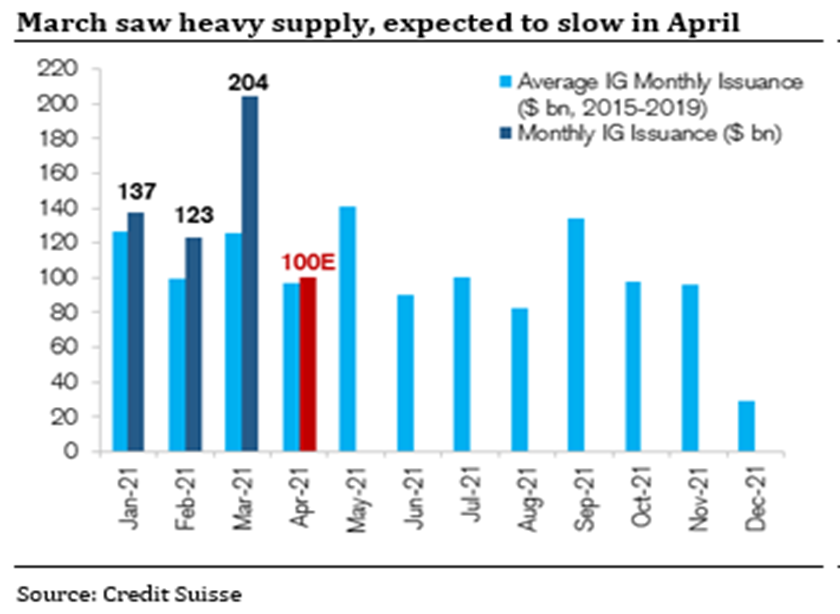

In 2020 the market witnessed record corporate bond issuance in both Investment Grade ($1.75tn) and High Yield ($432bn). Companies used low interest rates and cheap borrowing costs to plug liquidity holes caused by the pandemic, as well as raise additional excess liquidity. And due to the uncertain environment, there was a need to move swiftly. This resulted in a perfect storm for corporate bond supply.

But what was to come of 2021? As underwriters pondered the balance sheet needs of Corporate America, they settled around estimates for $1.25tn in Investment Grade and $340bn in High Yield, or -29% and -21%, respectively. While there was significant consensus around these estimates (Bank America Merrill Lynch was a notable outlier in predicting $963bn in Investment Grade), there are catalysts that could have a meaningful impact on credit spreads should there be a departure from consensus.

- There is strong support for supply to return to levels seen pre-2020. Corporate balance sheets are in a good position, given the work done in 2020 and earnings are rebounding with the economy reopening. Higher interest rates (relative to 2020) decrease the attractiveness of further bond funding. Many companies took advantage of the favorable environment in 2020 to term-out debt, making refinancing needs in 2021 less necessary. Even with higher yields this year, we believe companies should be taking advantage of the historically low yields to term out as much debt as possible.

- A significant input variable in the call for reduced supply was higher interest rates. Much ink has been spilled calling for higher rates and a steeper U.S. Treasury curve. Both serve as a disincentive to outsized issuance, both from an opportunistic standpoint as well as a less favorable environment (at the margin) for M&A activity. However, in the past two weeks, we have seen the two largest bank deals of all time – JP Morgan sold $13bn of bonds on 4/15, and Bank of America eclipsed that mark with $15bn the next day.

- What if spreads remain compressed and, contrary to market opinion, rates stay contained? Demand for risky assets remains elevated and backstopped by a cumulative $1.72tn of flows into money market funds since January 2019. With monetary policy pushing investors to look for yield, demand could be supportive of spreads with investors flush with cash. Given this, funding costs would remain depressed and could lead to outsized M&A activity which, in turn, could add to the supply picture.

BOTTOM LINE

The market appears to be set up for a period of equilibrium. Higher rates, as called for by many strategists, would argue for corporate bond issuance to fall significantly from 2020 levels, resulting in a sizeable amount of supply being taken out of the market – this at a time when there is high demand for spread product. On the flip side, should rates stabilize or migrate lower, there could be potential upside risk to supply estimates. As of 4/29/2021, YTD issuance in Investment Grade is $548bn and $196bn in High Yield. Estimates for May are approaching $140bn in Investment Grade. Will there be enough demand if companies continue this pace and dip heavily into the punchbowl a second time?

We are keeping a very keen eye on the incremental demand for credit and the potential for greater supply in the future.

Credit Suisse Credit Strategy Daily April 5, 2021

FOR INSTITUTIONAL INVESTOR USE ONLY

Let’s Talk – Smith Capital Investors

Our mailing address is:

Smith Capital Investors

1430 Blake Street

Denver, CO 80202

303-597-5555

833-577-6484

info@smithcapitalinvestors.com

www.smithcapitalinvestors.com

The opinions and views expressed are as of the date published and are subject to change without notice of any kind and may no longer be true after any date indicated. Information presented herein is for discussion and illustrative purposes only and should not be used or construed as financial, legal, or tax advice, and is not a recommendation or an offer or solicitation to buy, sell or hold any security, investment strategy, or market sector. No forecasts can be guaranteed, and the author and Smith Capital Investors assume no duty to and do not undertake to update forward-looking predictions or statements. Forward-looking predictions or statements are subject to numerous assumptions, risks, and uncertainties, which change over time. Actual results could differ materially from those anticipated in forward-looking predictions or statements.

Any investment or management recommendation in this document is not meant to be impartial investment advice or advice in a fiduciary capacity and is not tailored to the investment needs of any specific individual or category of individuals. Opinions and examples are meant as an illustration of broader themes, are not an indication of trading intent, and are subject to changes at any time due to changes in the market or economic conditions. The information presented herein has been developed internally or obtained from sources believed to be reliable; however, neither the author nor Smith Capital Investors guarantees that the information supplied is accurate, complete, or timely, nor are there any warranties with regards to the results obtained from its use. It is not intended to indicate or imply that any illustration/example mentioned is now or was ever held in any portfolio.

Past performance is no guarantee of future results. As with any investment, there is a risk of loss. Investing in a bond market is subject to risks, including market, interest rate, issuer, credit, inflation, default, and liquidity risk. The bond market is volatile. The value of most bonds and bond strategies are impacted by changes in interest rates. The return of principal is not guaranteed, and prices may decline if an issuer fails to make timely payments or its credit strength weakens. High yield or “junk” bonds involve a greater risk of default and price volatility and can experience sudden and sharp price swings.

Please consider the charges, risks, expenses, and investment objectives carefully before investing. Please see a prospectus, or, if available, a summary prospectus containing this and other information. Read it carefully before you invest or send money. Investing involves risk, including the possible loss of principal and fluctuation of value.

All indices are unmanaged. You cannot invest directly in an index. Index or benchmark performance presented in this document does not reflect the deduction of advisory fees, transaction charges, and other expenses, which would reduce performance.

This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission from Smith Capital Investors.

Smith Capital Investors, LLC is a registered investment adviser.

SCI00139