To view the PDF version, click HERE

The Wake-up Call

Powell’s testimony last week grabbed a lot of attention. While many are calling it an ‘abrupt pivot’, we believe it was a wake-up call – a reminder that monetary policy is in the early stages of transition. And with that transition, there will be volatility. It feels to us like Powell might be borrowing a few plays from Greenspan’s playbook, using his commentary to guide markets, and speaking with a lack of definitive clarity that keeps investors guessing, while also giving him a plethora of options to change his mind. It goes without saying that he is very clearly communicating to the market that inflation is no longer temporary and seems to be socializing the idea of removing the word ‘transitory’ from the current narrative (Thank God!). He also suggested that the Fed is considering an increase in the pace of tapering of asset purchases, ending the program earlier than originally expected (Another Thank God!). Throw in a new COVID variant (Omicron) and the market is getting quite the wake-up call after what has been a rather complacent period.

The reaction

The market reaction to Powell’s testimony and the new variant seems very logical, and in many ways, healthy in our opinion. We are hard pressed to believe there was a single individual that thought the bond buying program needed to continue, likening this to the fireman who continues to douse the smoldering embers long after the fire has been extinguished, eliminating the fire but creating a flooding problem. The ongoing emergency actions by the Fed in a time of improving economies and stable markets were hardly needed. We expect the acceleration of tapering to be brisk as the Fed has a very large balance sheet to contend with and will need that firepower to deal with future economic and market dysfunction.

Inflation

We have been somewhat surprised by the lack of care and complacency at the Fed around the recent heightened inflation readings. It is as though the message of ‘transitory’ was so strongly anchored that they ignored the fact that the bargaining power of labor is improving, and wages are likely headed higher. There is story after story of wage increases on the horizon and, we believe, many more to follow. It will be very interesting to see how economists adjust their 2022 view of inflation falling back to pre-covid levels as time passes. The consensus has both growth and inflation turning over in 2022, returning to longer term averages. We are skeptical of the consensus, favoring better growth coinciding with stickier and higher inflation.

As a reminder – Headline PPI came in at +8.6% YoY and Core PPI came in at +6.2% YoY (October). This was followed by headline CPI coming in at +6.2% YoY and Core CPI at +4.6% YoY (October). These levels are multi-decade highs, granted they are fueled by an unusual environment.

We are reluctant to argue with the four headed horsemen of disinflation (prior writings we spoke to a three headed horseman) – Demographics, Technological Innovation, Globalization and now Debt Overhang – but find ourselves a little concerned that both growth and inflation will settle out at levels higher than the consensus. Our thesis of a stronger, longer, and more durable recovery is clearly not matching up with the recent price action in the bond markets. The flattening of the curve and the decline in long rates is painting the exact opposite picture.

INSTITUTIONAL INVESTOR USE ONLY

30-yr Minus 2-yr U.S. Treasury Curve

Source: Bloomberg 12/7/2021

Source: Bloomberg 12/7/2021

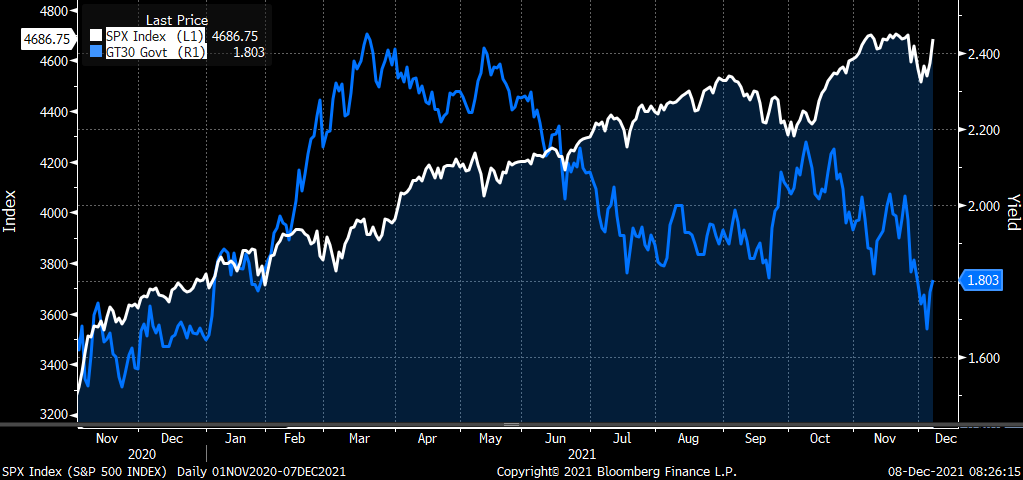

Negative or Positive – Correlations matter for asset allocators

Watching the trading relationship between stocks, credit, and bonds over the last couple of weeks show signs of normalcy returning – stocks down, credit wider, and bonds up (price). This indicates to us that the recent repricing of real rates has put the bond market in a better position to provide insurance (volatility protection) to investors as we enter periods of heightened equity volatility. Albeit some of the rally in the bond market was directly tied to a flight-to-quality bid due to the fear of the unknown – Omicron. But again, greater normalcy.

We believe this relationship is of critical consideration as the hatred for the bond market is reaching levels not seen since 2018. Investors share very openly their lack of faith in the bond market with a common focus on wanting to remain positioned in very, very short duration. Many are crowding into short duration and ultra-short strategies as holding places while we wait for higher rates, and eventually, wider spreads. We have been of a similar mindset but have previously shared with investors that our biggest fear was a quick reversal in rates in the long end. That seems to be playing out as we speak.

The ever-present disdain towards the bond market, with many investors favoring shorter duration positioning, could be driving some of the fuel for the recent rally. Maybe the wake-up call is broader than we think?

S&P 500 Index vs. 30-yr U.S. Treasury

Source: Bloomberg 12/7/2021

Source: Bloomberg 12/7/2021

INSTITUTIONAL INVESTOR USE ONLY

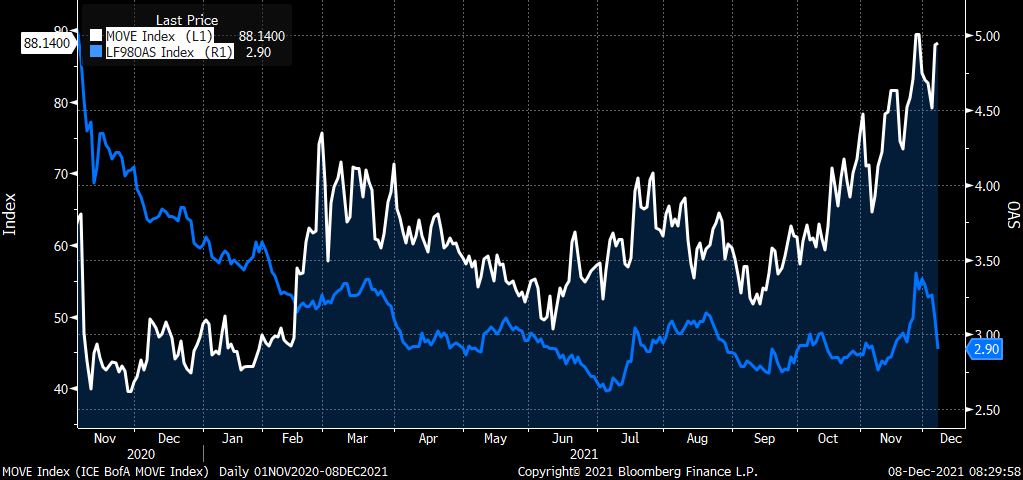

Volatility should have everyone’s attention

The volatility of rates and the yield curve gives us some pause. We have recently expressed over and over that rising rate volatility could find its way into the stretched valuations in the credit markets, with long duration credit the most vulnerable. While we noted some concerns around lower quality areas of the credit markets, we felt there was enough demand to keep a bid in those markets. As it turns out, lower quality credit bore the brunt of the heightened volatility with the front-end of the rates curve adjusting more aggressively to concerns around the changes in monetary policy. Relating this back to asset correlations, it seems to be a healthy sign that equity volatility (measured by the VIX) has spiked alongside rate volatility and credit spreads, especially during a year where “buy the dip & dip alpha” has been the key mantra from equity participants. We would argue this is another positive sign for markets as we slowly begin to migrate back to a more “normalized” world. We are finding new value in the front-end of fixed income markets and see some great opportunities on the horizon as the market prices in a more aggressive rate hike regime.

MOVE Index vs. Bloomberg High Yield Index OAS

Source: Bloomberg 12/7/2021

Source: Bloomberg 12/7/2021

Risk Assets hit a road bump: High Yield vs. Investment Grade spreads

Source: Bloomberg 12/7/2021

Source: Bloomberg 12/7/2021

Conclusion

After a period of complacency, it was time for a wake-up call in the marketplace. While it is always dangerous to draw strong conclusions from past experiences, it feels like we should expect greater volatility into year-end and into 2022, especially in rates and the yield curve. Competing forces including inflation/deflation, the virus, removal of monetary policy, and potential growth/recovery will keep volatility front and center, suggesting that long duration assets are vulnerable. The market’s transition from Fed supported to self-sustaining has historically proven to be one littered with speed bumps versus a relaxed straight line. As a reminder, with volatility comes opportunity and active management – both in regard to security selection and avoidance – allowing for better outcomes in a dynamic market environment.

To view the PDF version, click HERE

INSTITUTIONAL INVESTOR USE ONLY

Let’s talk – Smith Capital Investors

Our mailing address is:

Smith Capital Investors

1430 Blake Street

Denver, CO 80202

303-597-5555

833-577-6484

info@smithcapitalinvestors.com

www.smithcapitalinvestors.com

The opinions and views expressed are as of the date published and are subject to change without notice of any kind and may no longer be true after any date indicated. Information presented herein is for discussion and illustrative purposes only and should not be used or construed as financial, legal, or tax advice, and is not a recommendation or an offer or solicitation to buy, sell or hold any security, investment strategy, or market sector. No forecasts can be guaranteed, and the author and Smith Capital Investors assume no duty to and do not undertake to update forward-looking predictions or statements. Forward-looking predictions or statements are subject to numerous assumptions, risks, and uncertainties, which change over time. Actual results could differ materially from those anticipated in forward-looking predictions or statements.

Any investment or management recommendation in this document is not meant to be impartial investment advice or advice in a fiduciary capacity and is not tailored to the investment needs of any specific individual or category of individuals. Opinions and examples are meant as an illustration of broader themes, are not an indication of trading intent, and are subject to changes at any time due to changes in the market or economic conditions. The information presented herein has been developed internally or obtained from sources believed to be reliable; however, neither the author nor Smith Capital Investors guarantees that the information supplied is accurate, complete, or timely, nor are there any warranties with regards to the results obtained from its use. It is not intended to indicate or imply that any illustration/example mentioned is now or was ever held in any portfolio.

Past performance is no guarantee of future results. As with any investment, there is a risk of loss. Investing in a bond market is subject to risks, including market, interest rate, issuer, credit, inflation, default, and liquidity risk. The bond market is volatile. The value of most bonds and bond strategies are impacted by changes in interest rates. The return of principal is not guaranteed, and prices may decline if an issuer fails to make timely payments or its credit strength weakens. High yield or “junk” bonds involve a greater risk of default and price volatility and can experience sudden and sharp price swings.

Please consider the charges, risks, expenses, and investment objectives carefully before investing. Please see a prospectus, or, if available, a summary prospectus containing this and other information. Read it carefully before you invest or send money. Investing involves risk, including the possible loss of principal and fluctuation of value.

All indices are unmanaged. You cannot invest directly in an index. Index or benchmark performance presented in this document does not reflect the deduction of advisory fees, transaction charges, and other expenses, which would reduce performance.

This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission from Smith Capital Investors.

Smith Capital Investors, LLC is a registered investment adviser.

SCI00201