Corporate Credit Valuation in a Historical Context

At Smith Capital Investors, we are always looking for insights into what the markets are telling us and how these insights can inform our investment process. One key issue we find ourselves pondering is the probability that the Fed will be able to orchestrate a so-called “soft landing”, and in conjunction how will risk assets perform if the Fed is successful or unsuccessful in accomplishing their goals. We turned our attention toward corporate credit markets to provide further insight into the matter.

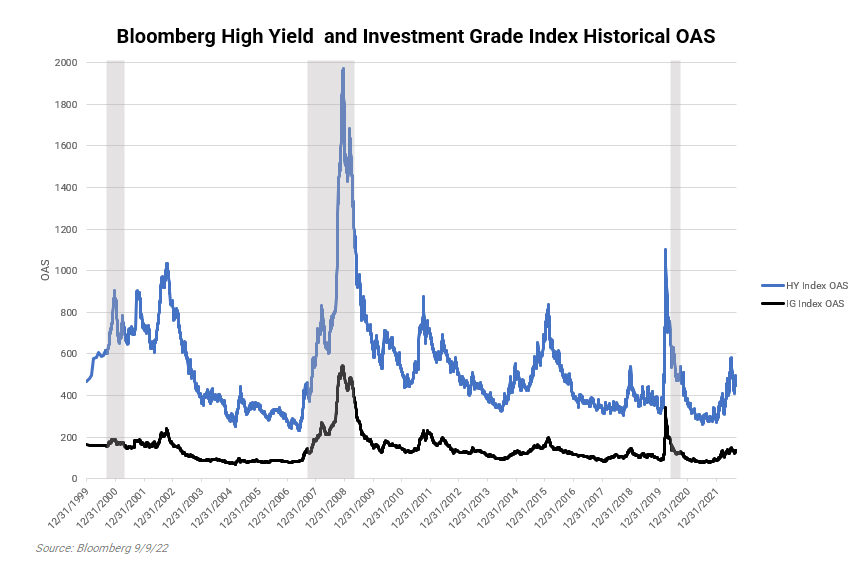

Looking at the last three NBER designated recessions (2001, 2007-2009, and 2020), the weighted average Option Adjusted Spread (OAS) for the Bloomberg US Corporate High Yield Bond Index (HY Index) during these defined recessionary periods was 945 basis points (bps), with peak spreads much higher than these levels. In investment grade credit, the OAS for the Bloomberg US Credit Index (IG Index) averaged 275 bps over these periods. For all other non-recessionary periods since 2000, the OAS for the HY Index and the IG Index averaged 487bps and 127bps, respectively. So how do these levels compare to current market pricing? As of 9/9/22, the HY Index OAS stands at 449 bps and the IG Index level was 131bps. While past performance may not be a good proxy for future results, current corporate credit spreads are close to historical non-recessionary levels and appear to be pricing in a low probability of a return to previously observed recessionary spread levels.

Another issue we frequently wrestle with is how much weight to assign to current yield levels (elevated vs history) vs spread levels (less favorable on a historical basis) when considering the attractiveness of the current market. Comparing historical yield-to-worst (YTW) metrics during recessionary and non-recessionary periods, we are left with similar findings to the OAS analysis above. While current YTW levels on the HY Index and IG Index are 16% and 28% above the post-2000 non-recessionary averages, these figures are still well below YTW levels seen during historical recessionary periods.

Comparing current spread and yield levels in US corporate credit markets to prior recessionary and non-recessionary periods, investors may conclude that these markets are pricing in a low probability of a near-term recession. While we are not confident in the ability to accurately predict a recession, we do feel that current market pricing incorporates a relatively benign view of the future, particularly given the unprecedented nature and magnitude of many important macroeconomic variables at play. That said, we continue to maintain a defensive posture in corporate credit with an emphasis on resiliency. No matter what future conditions materialize we know that the impact on individual company growth, earnings, and cash flows will be differentiated. As such, we are spending our time hunting for securities that may possess a more attractive risk/reward profile than the broader market.

INSTITUTIONAL INVESTOR USE ONLY

Let’s talk – Smith Capital Investors

Our mailing address is:

Smith Capital Investors

1430 Blake Street

Denver, CO 80202

303-597-5555

833-577-6484

info@smithcapitalinvestors.com

www.smithcapitalinvestors.com

The opinions and views expressed are as of the date published and are subject to change without notice of any kind and may no longer be true after any date indicated. Information presented herein is for discussion and illustrative purposes only and should not be used or construed as financial, legal, or tax advice, and is not a recommendation or an offer or solicitation to buy, sell or hold any security, investment strategy, or market sector. No forecasts can be guaranteed, and the author and Smith Capital Investors assume no duty to and do not undertake to update forward-looking predictions or statements. Forward-looking predictions or statements are subject to numerous assumptions, risks, and uncertainties, which change over time. Actual results could differ materially from those anticipated in forward-looking predictions or statements.

Any investment or management recommendation in this document is not meant to be impartial investment advice or advice in a fiduciary capacity and is not tailored to the investment needs of any specific individual or category of individuals. Opinions and examples are meant as an illustration of broader themes, are not an indication of trading intent, and are subject to changes at any time due to changes in the market or economic conditions. The information presented herein has been developed internally or obtained from sources believed to be reliable; however, neither the author nor Smith Capital Investors guarantees that the information supplied is accurate, complete, or timely, nor are there any warranties with regard to the results obtained from its use. It is not intended to indicate or imply that any illustration/example mentioned is now or was ever held in any portfolio.

Past performance is no guarantee of future results. As with any investment, there is a risk of loss. Investing in a bond market is subject to risks, including market, interest rate, issuer, credit, inflation, default, and liquidity risk. The bond market is volatile. The value of most bonds and bond strategies are impacted by changes in interest rates. The return of principal is not guaranteed, and prices may decline if an issuer fails to make timely payments or its credit strength weakens. High yield or “junk” bonds involve a greater risk of default and price volatility and can experience sudden and sharp price swings.

Please consider the charges, risks, expenses, and investment objectives carefully before investing. Please see a prospectus, or, if available, a summary prospectus containing this and other information. Read it carefully before you invest or send money. Investing involves risk, including the possible loss of principal and fluctuation of value.

All indices are unmanaged. You cannot invest directly in an index. Index or benchmark performance presented in this document does not reflect the deduction of advisory fees, transaction charges, and other expenses, which would reduce performance.

This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission from Smith Capital Investors.

Smith Capital Investors, LLC is a registered investment adviser.

SCI00318