Inflation: Transitory Factors Collide with the Base Effect

We are in our second week of shocks from the economic data: first with the miss from ISM Manufacturing on supply chain disruptions, then the miss from Nonfarm Payrolls and now a higher-than-expected rise from Core CPI. While all three have caught the market off-guard, it is important to remember that we closed the economy for two months in 2020 in addition to rolling closures throughout the last twelve months. This makes for a large mismatch in timing, creating massive bottlenecks and thus extremely volatile data – and for this week, a collision of factors within the inflation report.

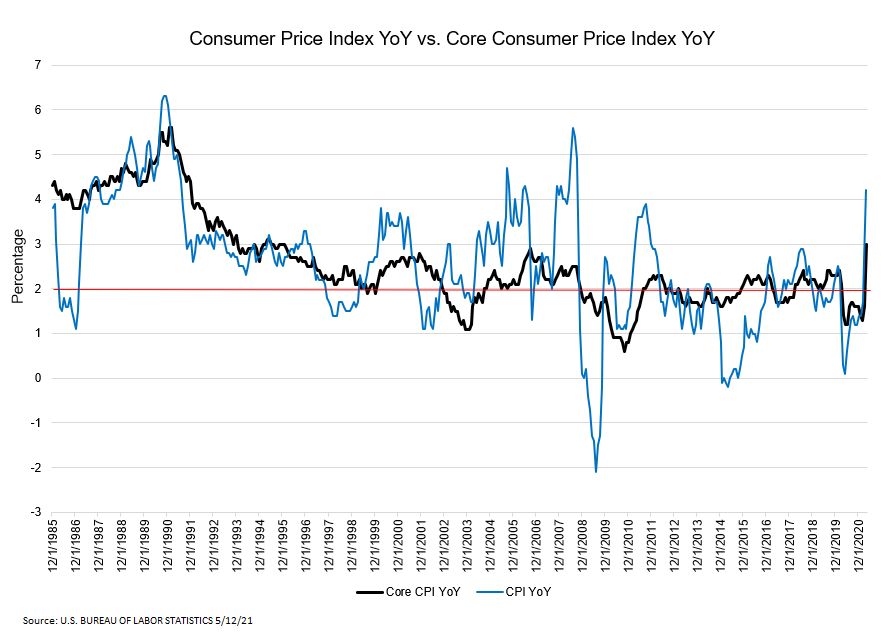

The Consumer Price Index rose 0.8% this month and is up 4.2% YoY while the Core CPI number rose 0.9% this month and is up 3% YoY. The “base effect” has been well communicated in the market and April recorded the largest impact from this effect. Recall that April 2020 was down -0.4%, this number “rolled off” and was replaced by a 0.9% increase, overall elevating the YoY print.

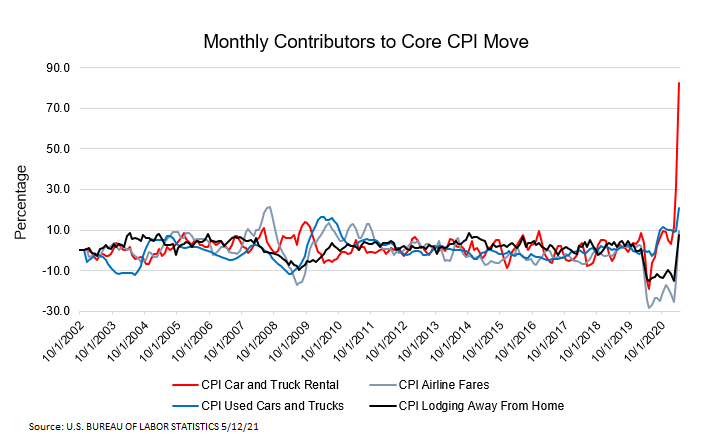

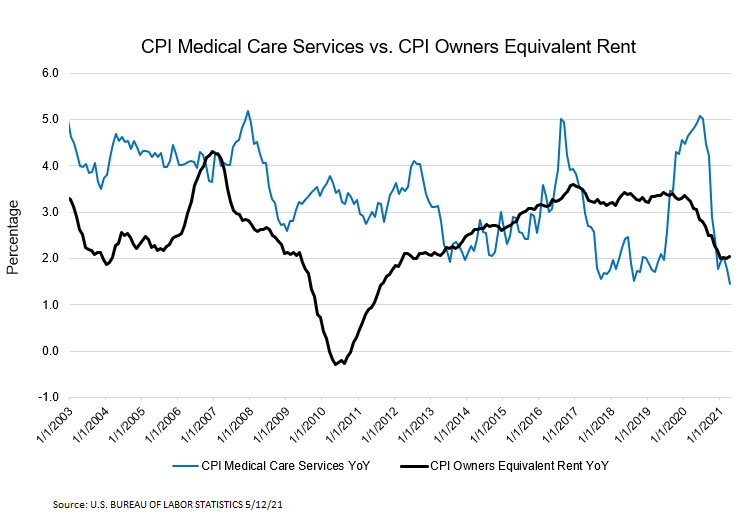

Additionally, four traditionally volatile components are responsible for the majority of the monthly increase while categories such as Owners’ Equivalent Rent (OER), which makes up one-third of Core CPI, was stable this month and Medical Services reported flat.

- Car and truck rental rose 16.2% this month, 82.2% YoY

- Airline fares rose 10.2% this month, 9.6% YoY

- Used cars and trucks rose 10% this month, 21% YoY

- Lodging away from home rose 7.6% this month, 7.4% YoY

- Owners’ equivalent rent rose 0.2% this month, 2% YoY

- Medical care services rose 0% this month, 2.2% YoY

INSTITUTIONAL INVESTOR USE ONLY

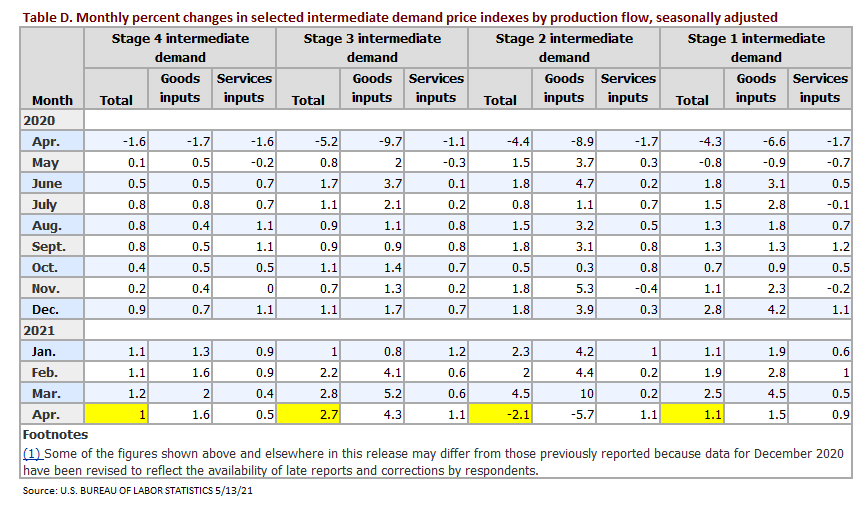

To further support the view that pressures are transitory due to the economic reopening, we are starting to see prices rise at a slower pace within the Producer Price Index (PPI). Stages 1, 3 and 4 within intermediate demand rose at a slower pace in April while Stage 2 for intermediate demand declined 2.1%. We will continue to watch the early stages of the pipeline for signals that pressures are normalizing.

INSTITUTIONAL INVESTOR USE ONLY

As we normalize and work through supply chain disruptions as well as the base effect, we will end the year above the Fed’s 2% target. Moving into 2022, we will continue to shed the impact of the base effect into the April-June 2022 time-period and normalize back to the 2% target level. Working through an economy that shut down completely, then reopened with massive amounts of liquidity and pent-up demand is going to take some time to smooth out. This will continue to create massive pockets of volatility in both the data and the broader market.

Let’s talk – Smith Capital Investors

Our mailing address is:

Smith Capital Investors

1430 Blake Street

Denver, CO 80202

303-597-5555

833-577-6484

info@smithcapitalinvestors.com

www.smithcapitalinvestors.com

The opinions and views expressed are as of the date published and are subject to change without notice of any kind and may no longer be true after any date indicated. Information presented herein is for discussion and illustrative purposes only and should not be used or construed as financial, legal, or tax advice, and is not a recommendation or an offer or solicitation to buy, sell or hold any security, investment strategy, or market sector. No forecasts can be guaranteed, and the author and Smith Capital Investors assume no duty to and do not undertake to update forward-looking predictions or statements. Forward-looking predictions or statements are subject to numerous assumptions, risks, and uncertainties, which change over time. Actual results could differ materially from those anticipated in forward-looking predictions or statements.

Any investment or management recommendation in this document is not meant to be impartial investment advice or advice in a fiduciary capacity and is not tailored to the investment needs of any specific individual or category of individuals. Opinions and examples are meant as an illustration of broader themes, are not an indication of trading intent, and are subject to changes at any time due to changes in the market or economic conditions. The information presented herein has been developed internally or obtained from sources believed to be reliable; however, neither the author nor Smith Capital Investors guarantees that the information supplied is accurate, complete, or timely, nor are there any warranties with regards to the results obtained from its use. It is not intended to indicate or imply that any illustration/example mentioned is now or was ever held in any portfolio.

Past performance is no guarantee of future results. As with any investment, there is a risk of loss. Investing in a bond market is subject to risks, including market, interest rate, issuer, credit, inflation, default, and liquidity risk. The bond market is volatile. The value of most bonds and bond strategies are impacted by changes in interest rates. The return of principal is not guaranteed, and prices may decline if an issuer fails to make timely payments or its credit strength weakens. High yield or “junk” bonds involve a greater risk of default and price volatility and can experience sudden and sharp price swings.

Please consider the charges, risks, expenses, and investment objectives carefully before investing. Please see a prospectus, or, if available, a summary prospectus containing this and other information. Read it carefully before you invest or send money. Investing involves risk, including the possible loss of principal and fluctuation of value.

All indices are unmanaged. You cannot invest directly in an index. Index or benchmark performance presented in this document does not reflect the deduction of advisory fees, transaction charges, and other expenses, which would reduce performance.

This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission from Smith Capital Investors.

Smith Capital Investors, LLC is a registered investment adviser.

SCI00140