Reflections Post Silicon Valley Bank Collapse

After the Great Financial Crisis (GFC), U.S. regulatory bodies set out to increase oversight over our nation’s largest banks. The new environment has resulted in minimum capital ratios, minimum liquidity buffers, stress testing, and broad capital allocation approvals, among a long list of others.

The very best banks, with prudent risk management practices, do these things naturally, and we have found their oversight and risk management to be far deeper than the minimum requirements set by the regulators. This new regulatory environment has largely benefited the creditors of these institutions via quantifiably improved credit profiles.

A reminder that the risks of the GFC were focused on the largest banks that have been diagnosed as Global Systemically Important Banks (G-SIBs). SVB was not one of these institutions.

Our banking system relies heavily on trust. Namely, trust that when someone or a company deposits money at a bank, they will be able to retrieve that money when they want. When that trust is challenged, we see deteriorating confidence morph into fear, followed by panic. This fear/panic combination is typically found at the heart of a bank run. There was no exception to this pattern at SVB.

Rather than going into the specifics of what ignited that snowballing fear and jeopardized people’s confidence in SVB, let us turn to focus on the reverberations, fallout, and consequences of their bankruptcy.

Firstly, we do not see the same relative magnitude of issues across our coverage of U.S. financial institutions that exasperated the risks for SVB. This said, we do believe a few things are likely to happen as a result:

- Valuation: The premium regional banks have historically garnered will be tested.

- Funding and Margins: Competition for deposits will increase.

- Credit Creation: The propensity to lend will decrease.

INSTITUTIONAL INVESTOR USE ONLY

Valuation

In the post-GFC financial market landscape, regional banks have typically gathered a premium on both the equity (P/E) and credit (spreads) sides of their funding models.

Over the past several weeks, we have witnessed regional bank spreads underperform those of their larger, G-SIB peers as investors demand additional compensation for the greater perceived risks at these institutions. Going through fundamental profile differences we do not believe that 100% of the discount between regionals and G-SIB’s in the market can be explained by fundamental differences alone. Moving forward, despite the sheer and significant differences in the amount of public outstanding debt, it will be hard to justify the once garnered, broad-based premium (tighter) in spreads that regional banks received relative to their larger and more heavily regulated G-SIB peers. We have long favored G-SIB capital structures for these reasons and others, and we wouldn’t be surprised if the marketplace comes to a similar position over time.

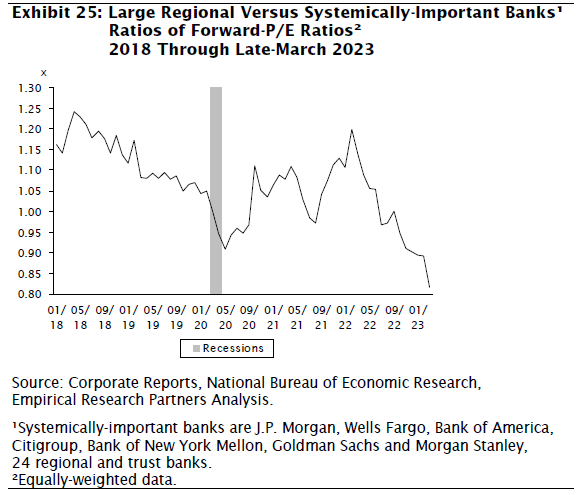

On the equity side, we have seen a similar reversal. Over the past month, the ratio of large regional banks to G-SIB forward P/Es has hit its lowest in the past several years.

Funding and Margins

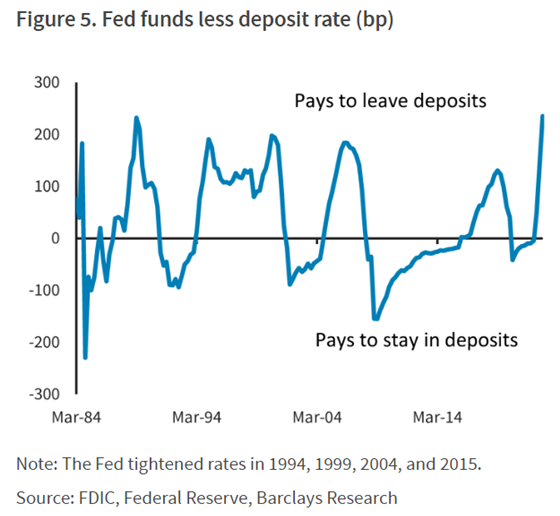

Deposits are typically the lifeblood of a bank funding model. With interest rates having been low for so long, ample in supply, of limited competition, deposits have been a very cheap source of funding for banks.

In the quarters prior to SVB, some of the largest banks have even been trying to decrease the number of deposits they have.

With interest rates no longer near zero, banks have been passing along some interest income to depositors. However, it has not been nearly commensurate with the pace and magnitude by which the Fed has lifted Fed Funds. In fact, the difference between Fed Funds and average deposit rates is near its highest in decades.

We wouldn’t be surprised if the SVB situation served as a “shake awake” moment for banks, particularly those small and mid-sized banks that need to protect their funding models more aggressively. We anticipate depositors may see more favorable rates from these institutions. With funding costs likely to go up on both the wholesale and deposit side, we would expect margins to come under pressure moving forward.

Furthermore, we wouldn’t be surprised to see an intra-industry deposit mix reshuffling as deposits move away from weaker perceived institutions to those that are stronger. Without drawing specific lines in the sand, we would expect the biggest banks to be viewed as safe havens and continue to be deposit share takers.

Credit Creation

There can be no doubt that fear of systemic contagion gripped the market for the hours and days immediately surrounding the collapse of SVB. While that contagion fear has subsided, we do think banks will take a more cautious stance on lending over the next several quarters at a minimum. This will not necessarily be driven by concerns over asset quality, which typically drive the expansion or shrinking of credit boxes, but rather the desire to not become overextended in an environment where there is still turbulence on the funding side of balance sheets.

Conclusion

Year-to-date, we have charted anything but a straight line. Looking to the horizon for the rest of the year, we do not see anything to change this. More immediately, as we approach earnings season, it will be a rich environment for information and clues not the least of which will be data and information on deposits, loan growth, and margins in the industry that serves as the conduit system for this economic engine in which we find ourselves. We start that process this Friday. Stay tuned.

INSTITUTIONAL INVESTOR USE ONLY

Jonathan Aal

Portfolio Manager Credit Opportunities Fund

Let’s keep talking!

Smith Capital Investors

Our mailing address is:

Smith Capital Investors

1430 Blake Street

Denver, CO 80202

303-597-5555

833-577-6484

info@smithcapitalinvestors.com

www.smithcapitalinvestors.com

The opinions and views expressed are as of the date published and are subject to change without notice of any kind and may no longer be true after any date indicated. Information presented herein is for discussion and illustrative purposes only and should not be used or construed as financial, legal, or tax advice, and is not a recommendation or an offer or solicitation to buy, sell or hold any security, investment strategy, or market sector. No forecasts can be guaranteed, and the author and Smith Capital Investors assume no duty to and do not undertake to update forward-looking predictions or statements. Forward-looking predictions or statements are subject to numerous assumptions, risks, and uncertainties, which change over time. Actual results could differ materially from those anticipated in forward-looking predictions or statements.

Any investment or management recommendation in this document is not meant to be impartial investment advice or advice in a fiduciary capacity and is not tailored to the investment needs of any specific individual or category of individuals. Opinions and examples are meant as an illustration of broader themes, are not an indication of trading intent, and are subject to changes at any time due to changes in the market or economic conditions. The information presented herein has been developed internally or obtained from sources believed to be reliable; however, neither the author nor Smith Capital Investors guarantees that the information supplied is accurate, complete, or timely, nor are there any warranties concerning the results obtained from its use. It is not intended to indicate or imply that any illustration/example mentioned is now or was ever held in any portfolio.

Past performance is no guarantee of future results. As with any investment, there is a risk of loss. Investing in a bond market is subject to risks, including market, interest rate, issuer, credit, inflation, default, and liquidity risk. The bond market is volatile. The value of most bonds and bond strategies are impacted by changes in interest rates. The return of principal is not guaranteed, and prices may decline if an issuer fails to make timely payments or its credit strength weakens. High yield or “junk” bonds involve a greater risk of default and price volatility and can experience sudden and sharp price swings.

Please consider the charges, risks, expenses, and investment objectives carefully before investing. Please see a prospectus, or, if available, a summary prospectus containing this and other information. Read it carefully before you invest or send money. Investing involves risk, including the possible loss of principal and fluctuation of value.

All indices are unmanaged. You cannot invest directly in an index. The index or benchmark performance presented in this document does not reflect the deduction of advisory fees, transaction charges, and other expenses, which would reduce performance.

This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission from Smith Capital Investors.

Smith Capital Investors, LLC is a registered investment adviser.

SCI00362